UPDATE: This offer has expired. The official offer is back down to 40,000 miles. However, there are “unofficial” AAdvantage credit card offers that still offer 50,000 miles. Go to the bottom of the post to learn more.Â

In October, American launched an official 50,000 mile offer for their Citi Platinum Select/AAdvantage Visa Signature credit card. The reason I say “official” is because there has been an unofficial 50,000 mile offer around for awhile now, but it takes you right to the application page with no landing page stating the actual offer so you are taking a slight risk (although this has been working for many!).Â

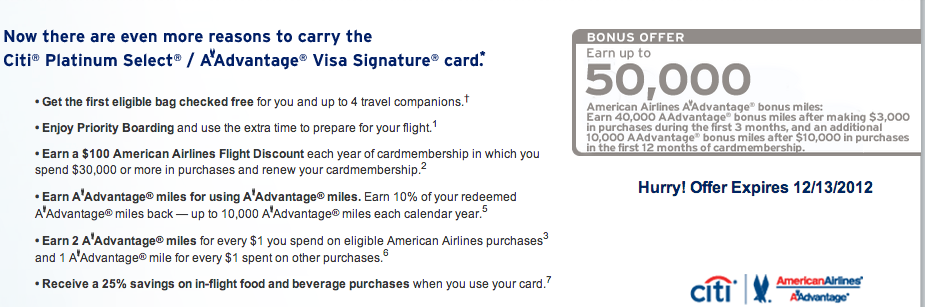

If you are more risk adverse and want to ensure you are applying for the right card offer with 50,000 miles, the offer is expiring today, December 13. After this, the offer will probably go down to 30,000 miles. Now, while 50,000 miles sounds great, the minimum spend requirements are a little tough. You’ll receive 40,000 miles after you spend $3,000 in the first 3 months (that is the easy part), and an additional 10,000 miles after you spend $10,000 in the first 12 months. The 2nd portion only means $834/month, but as many of you know, putting your everyday spend on the American Airlines card is not a good idea. While I love my AA miles, you want to put your spend on the Starwood Amex card for 1) the flexibility, and 2) the 5k bonus for 20k point transfers. I personally got the AAdvantage Visa personal card a few years ago when you could get 75,000 miles and although I do not use this card for my everyday spend, I do keep it for the 10% back on redeemed miles perk. I did, however, close the business version of the card as there was no need for me two pay two annual fees.

Other card perks:

- First checked bag free for up to 4 passengers on the same itinerary — if you do not have status, this can be a great perk

- Priority boarding

- Earn a $100 flight certificate after spending $30,000 on the card annually

- Earn 10% back on your redeemed miles – up to 10,000 in a calendar year — this is one of the best perks of the card

- Earn 1 mile/$1 spend on the card

- Earn 2 miles/$1 spent on American Airlines purchases

- Annual fee waived for the first year then $95/year

- You must use two different Internet browsers if you apply from the same computer (i.e., apply for one on Internet Explorer and the other on Firefox) or just use two different computers to make it easier

- Apply for two different versions of the card – there is a Visa, American Express, and World Mastercard (all three for personal cards) – for whatever reason, people suggest the Visa and Amex cards

- You must apply for the two cards on the SAME DAY – if you wait till the next day you will not get approved as you are no longer a new cardholder

- Citi will only allow you to apply for 2 Citi cards in the same 65 day period – if you’ve recently applied for another Citi card within this timeframe, you will get denied

- For personal cards, Citi typically allows you to re-apply for the same card after 18 months of last application (your first card does not have to be cancelled)

- For business cards, Citi typically allow you to re-apply every 3 months from the time you cancelled the card

**Remember, the unofficial links are direct links to the card application and DO NOT give the specific details of the offer. Many people have reported success on these offers, but I take no responsibility if they do not work for you (although, I am VERY confident in them!). You can check out this FlyerTalk thread to see the various versions of the unofficial links.

Disclaimer: The official AAdvantage Visa Signature card is an affiliate link. As always, thanks for the support and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Do you know if the Citi Business card is churnable? If so, how often?

@Maury – Every three months after cancelling it

Are the Personal Visa and Amex still churnable over 18 months?

@Harold – As Glenn mentioned they are, but you are always better safe than sorry, so waiting a few extra months is a good idea.

@Harold – Consensus seems to be that Citi is tightening up. 20-24 months is more reliable. 18 months sometimes works, sometimes doesn’t and since you may see a hard pull even thought they turn you down, weigh that as part of your consideration. Sounds like 20+ months (from Application) is safer.

When do you find out if the unverified links worked? Do you need to spend the money first?

@Jeff – After you apply you can call Citi and just verify the offer.

Let’s say you apply for Signature and Business cards, spend $2500 and $3000 respectively, get the miles but then cancel both before the year is up. Do still get to keep the miles? And if so, do you have only the year to use them before getting charged the $85/$75 card fee?

@Pav – Yes, you will still get to keep the miles. Typically you need to keep the card for at least 60 days.

[…] bonus on this card is 30,000 points, but there have been unofficial 50,000 point offers. Check out this post to learn more about the offer (both official and unofficial […]

Two days ago I applied for the “Aadvantage Business Visa” 50,000 mile card using the link above. Upon submitting the application, I immediately got a message stating my app had been declined. Today I called 800-763-9795 (personal and business card app status number) to find out why. To my surprise, I learned that I had actually been approved, and confirmed I would be receiving 50,000 bonus miles with annual fee waived the first year. Bizarre!!

Thirteen months ago I applied for the Aadvantage VISA Signature and VISA Business cards simultaneously on 2 different browsers, the deal went thru and I received 40k miles for each. Using your link, I just tried doing the same for the Aadvantage AMEX and VISA again, but they declined the VISA due to restrictions on processing 2 apps at the same time- said I need to wait 60 days. The good thing is that they confirmed 50k miles for the AMEX card. Thank you for the tip.

I just applied for the Citi American Express card (February 18, 2013) through this link, so it still works!!! I spent $5,000 in the first month of card membership, and my 50,000 bonus miles posted to my account. 🙂