While many people hate paying an annual fee, I personally do not mind. That is when it is for an American Express credit card. The more American Express annual fees I pay means the more credit cards I have which means the more money I am making on a yearly basis!

For every single American Express credit card I have, I am able to not only justify the annual fee, but am able to make money by simply having the card! If you’ve been keeping up on this blog for awhile you are probably well aware by now that I am a huge fan of saving money through the American Express statement credit offers. These promotions typically require you to spend $X amount of money at a participating merchant to get $Y amount back as a statement credit. As the name would imply, these offers are only granted to those using a registered American Express credit card at a participating merchant.

Let’s look at my Starwood credit card over the past year as an example. With this card I’ve receive a statement credit for the following American Express offers:

- Home Depot – $15

- Whole Foods – $10

- Fairway – $15

- Sam’s Club – $20

- Big Daddy’s – $15

- Newegg – $25

- Hyatt – $30

- Staples – $25

- Babies R Us – $5

- Office Max – $10

- Bob & Holly’s – $10 (restaurant for Small Business Saturday)

- British Beer Factory – $20 (restaurant for Small Business Saturday)

- J. Crew – $25

- Staples – $20

- Walmart – $5

- Big Daddy’s – $10

- Manhattan – $25 (no idea what this offer was for!)

- Bed Bath & Beyond – $5

- Fairway – $30

- Dunkin’ Donuts – $5

- Dry Bar – $10

So in just the last 12 months, I’ve received $335 back for purchases I would have made anyways. Not one of them required me to spend more than I normally would have. Since this was with the Starwood card which currently carries a $65 fee, the statement credits were able to pay for the annual fee, and then I was able to pocket an extra $270. While this particular card is going up to $95 a year, assuming the statement credit trend stays the same, it will still be worth it! To top it off, all authorized users on my card (which do not cost extra for most cards) are also eligible to take advantage of many of the American Express statement credit offers. So even though you are only paying the annual fee on one card, you are able to take advantage of the offers on two cards, for instance.

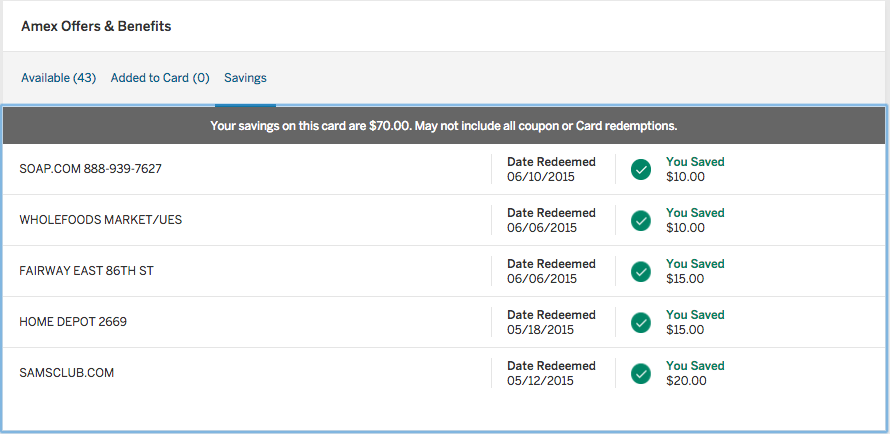

And remember, this was just for my Starwood card. I have many other American Express credit cards that also receive statement credit! For example, in just the past 30 days on my Amex EveryDay card (no annual fee version) I’ve received $70 back in statement credits! This is amazing for a card that I do not even have to pay for! With this card (and all other no annual fee cards), I’ll always come out ahead. These cards also allow authorized users for no fee and are eligible for the Amex Offers.

While I love the benefits of many of the American Express cards for a variety of reasons, having the annual fee essentially paid for while making money is one of the better perks in my opinion! It also helps with a piece of mind knowing you aren’t paying so much to have a card that you aren’t 100% sure whether or not the benefits will outweigh the fee.

There are MANY American Express cards out there and many of them you probably already have in your wallet but just didn’t know that you were eligible for this benefit! Here is a list of all the American Express credit cards you can use to take advantage of the Amex statement credit offers!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

some justify, most rationalize

I use the same justification for my Amex gold and preferred but I should point out I’ve gotten almost identical offers with my no fee Amex Hilton and blue cash cards

@Presley – Yes, you typically do not get better offers by having a card that has an annual fee vs. a no annual fee card.