A few days ago I wrote about an awesome offer for all three Southwest credit cards. All three cards are offering 60,000 bonus points which we’ve never seen before. Typically the offer is 25,000-40,000 points and when a “limited time offer” comes around it is raised to 50,000 points. There are also times where one of the cards might jump to 60,000 points, but this time around it is all three cards with this increased 60,000 point offer!

Key Links:

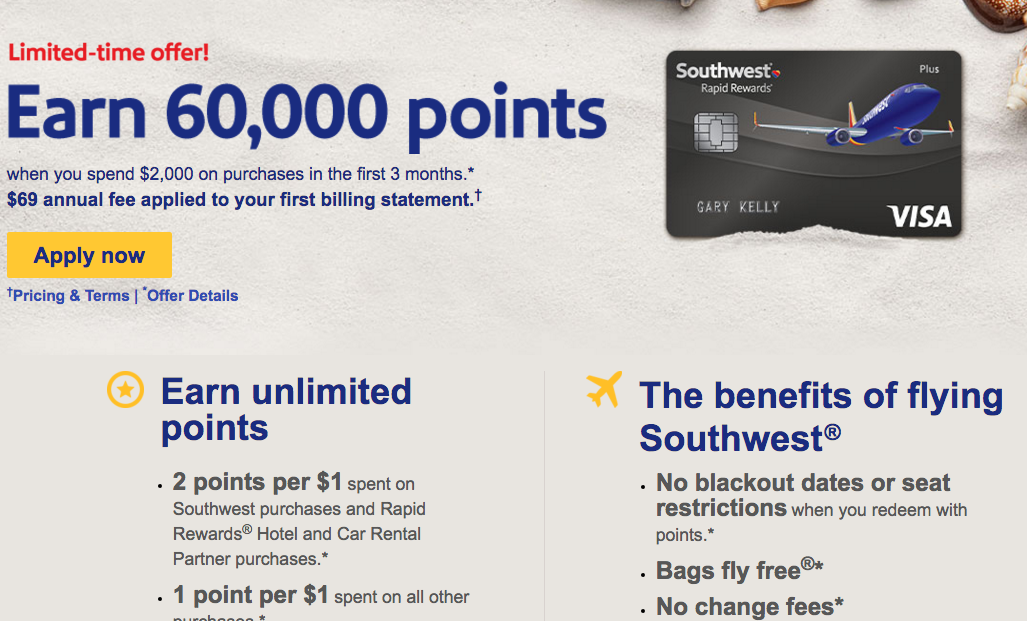

- Southwest Airlines Rapid Rewards Plus Card: Earn 60,000 points after spending $2,000 on the card within the first 3 months; $69 annual fee. This card will earn you 3,000 bonus points on your account anniversary. You can learn more about Airline credit cards here.

- Southwest Airlines Rapid Rewards Premier Card: Earn 60,000 points after spending $2,000 on the card within the first 3 months; $99 annual fee. This card will earn you 6,000 bonus points on your account anniversary. You can learn more about Airline credit cards here.

- Southwest Airlines Rapid Rewards Premier Business Card: Earn 60,000 points after spending $3,000 on the card within the first 3 months; $99 annual fee. This card will earn you 6,000 bonus points on your account anniversary. You can learn more about this credit card here.

*If you have any questions on which credit card to apply for, feel free to email me!

While earning this amount of Southwest points is awesome for those looking to increase their Southwest balance to redeem for some free flights, one of the real benefits is that the points earned from the sign up offer DO count towards the points needed to earn the Southwest Companion Pass. For those of you not aware of this Companion Pass, you can read this post here. But essentially, it allows someone to fly with you an unlimited number of times for free (plus taxes/fees) for the life of the pass. The pass expires December 31st the following year you earn it.Â

So if you are looking to earn the pass, an easy way is to sign up for two Southwest credit cards. Since each card earns you 60,000 points, that will give you a total of 120,000 points. To earn the pass, all you need is 110,000 points. Apply for two cards, get approved, meet the minimum spend, and you are done – the pass is yours! But, you will not earn the pass immediately upon applying for the cards. Remember, you must meet the minimum spend! So that means you must spend $2,000 on each card within three months. Once you meet the minimum spend, the points will post to your Southwest account a few days after your statement close date. So if you meet the minimum spend on the 1st of the month and your statement doesn’t close until the 26th, the points probably will not him your account until around the 30th. So you’ll have to wait until then! This is why knowing your statement close date is important! And to make sure you maximize the length of the pass, it is a good idea to try to spend the $2,000 on each card as soon as possible!

I’ve personally had the Southwest Companion Pass for close to 10 years so if you have any questions about earning the pass or using the pass, let me know!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great article. Just applied for the biz card. Received it. Have a dumb question. Will the account info and points info show up in my same chase account or do i have to re-add it to chase online? its not showing up!!

@Reisa – Sometimes with business cards you have to manually add it.

If I apply this week and spend the required amount will the points post before the end of the year. I already have 70000 points for this year

@James – If you apply now, I assume you’ll have a statement close date in December, but I am not 100% sure. IF you have a statement close date in December and meet your minimum spend by that date, then your points should post in December (assuming the statement close date isn’t past the 25th of the month). I am not 100% sure this will work though.

I applied for the business card in November and reached the minimum spend by my closing date of Dec 14th but haven’t received the bonus points yet as of 12/20. They only gave me the regular points. Do you know if they are earned in 2017 if they will still count towards my companion pass even if they don’t hit my account yet? The lady at Southwest that I spoke to said they would but I’m skeptical that they saw I was about to hit companion pass and are now going to wait until January to give me the bonus points…

@Peryn – Typically bonus points post a few days after the statement closing date. Based on past experience, you should receive within the next day or two at the latest, although I would have already expected them to post. Are you 100% sure you met the minimum spend NOT including the annual fee you paid?

Companion Pass points count based on when they are posted. So if posted in 2018 unfortunately they will count towards 2018 and not 2017. Did you speak to Southwest customer relations or just their reservations line?

I received the business card and did not get the bonus points until 3 days after my second statement. I did meet the required spending and more on the first statement.

@Pete – Thanks for that data point.

@dealswelike I did meet the minimum spend requirement without the annual fee. I spoke with customer relations and the person I spoke with said it could take 6-8 weeks although, like you, I have always received the bonus points pretty soon after closing date once earned. I’m going to give it until Friday 12/22 but I have a feeling they are just trying to not give me the points until January so that I won’t qualify…if you have any other advice it is very much appreciated!

@Peryn – Someone just posted that they didn’t receive the points until after their 2nd statement close date. I really hope that doesn’t happen to you. The terms do state that the points post 6-8 weeks after minimum spend is met, so they legally have covered themselves. With that being said, I truly do not believe they are purposely holding your points until January so you do not earn the pass. It is all system generated. Fingers crossed points post.

I received the companion pass this past April but it says only good until 12/31/17. I thought it would be good until 2018.

I currently have 67000 towards new pass when should I increase points in order to earn this pass for 2 yrs I can apply for another card but will do when points are higher. When do I need to make my due date on my statement, in order to maximize receiving pass for 2 yrs. also do my points on my business card go towards pass or is that separate? Thanks

@Nancy – It will always say it expires December 31st of that year. Then the following year you’ll receive it again automatically.

Since you already have the pass till 12/31/2018, the points you have right now unfortunately are not worth anything. The points towards the companion pass expire on December 31 of that calendar year and resets to 0 starting January 1st. If you are looking to earn the companion pass again for another two years, you’ll want to start accruing points again on January 1, 2019. Let me know if this helps!

Well now I’m thoroughly confused. I called southwest & the lady told me that pass expired 12/31/17 & in order to have a pass for 2018 I need to get to 110,000 which it shows on my account? I tried to do a screen shot but my computer wouldn’t allow me to for some reason?

Hello! I am applying for the two cards to receive the bonus points that will make me eligible for the companion pass. Do I need to earn all bonus points in the same calendar year? I applied for the first card today, 9/6. So I must spend the 2k to earn the bonus points by December 6 (3 months). I will then get the other card, and spend the minimum to receive another bonus. This will happen by February. So the first bonus is earned in December, and the second in February. Will I be eligible because I reach the 110,000 points in February 2018, or will I not be eligible because half of those were awarded in December 2017? Thanks for the insight.

@Angela – Yes, all the bonus points need to be earned in the same calendar year. They do not carry over to the next year.

The only work around would be to change your statement close date. So if your statement close date is December 2nd for example, and if you spend the last dollar on the $2,000 minimum spend, the points will not post until a few days after the statement close date when you met the minimum spend. So if your statement closes on the 2nd of every month, and you meet the minimum spend on December 6th, then it will not post until a few days after January 2nd closing date. That will then help you earn the entire 110,000 points in the 2018 calendar year.

Feel free to email me if you have more questions. But call Chase quickly to have them change the close date. And also get 100% verification on when you need to meet the minimum spend. Hope this helps!

Southwest has the 60,000 points deal going now, but not sure when it will end. I want to get the card so I can get the Companion Pass in 2018. I assume the Bonus Points apply toward the Pass in the year they are posted to your account. Do you know if I applied later in the month of September, when they would set my Statement date and if I waited until December to spend the $2,000 requirement, would the Bonus Points get posted in January? Their information says to expect up to 8 weeks for the points to post. Thanks

@Dave – Typically the bonus points post within a few days after the statement close date (not the 8 weeks like they state).

@ Dave – Hypothetically, if you were to open the account Sept 15th, then your 3 Month window would expire on Dec 15th. So, move your Statement closure date to the 3rd or so, and then spend the last of the $2000 between Dec 4th & 15th. You will be within the window, but it will not post until your next statement date, Jan 3rd; securing the points for the 2018 year. (If i’m wrong, hopefully someone will let me know!)

@Justin – That is 100% correct! To play it safe, probably better off waiting to October 1 to apply though.

So is it safe to apply now and get the points posted in January?

You only have 3 months to spend $2000, but if I apply on 9/11/17, what is the lead time to get the car, and spend by the end of 3 months and still have posted bonus in January?

Or do I need to wait another few weeks before applying?

Thanks!

@dan – to play it safe, you are better off waiting till october 1 to apply.

HI!!! I just made the mistake of applying and getting approved for a card with 60k points. I’m nervous because it will be arriving any day. If by chance I receive the card the last week of September, I’m close to October. I should have waited until December 30 to apply but I mistakenly did not. What’s the best plan of action to get the points in January 2017? Can I call Chase and ask them to wait to issue the card until later in the year? Can it be postponed?

@stacia – send Chase a secure message asking them when you must hit the minimum spend on the credit card. Sometimes it can be up to 115 days. If it is in fact a date in December, then you’ll want to change your statement close date to the 1st of the month, then hit your minimum spend between December 2nd and whenever your minimum spend expiration date is. That will ensure your points post in January. I recently posted about this, so make sure to look at recent articles regarding the Southwest Companion Pass.

If you apply in Septemeber, THE KEY is to not to exceed your spend amount until after your December statement closes. So what I did was as soon after I got approved (yesterday)

I called and asked them what was my statement date to figure out that therefore then I got in writing in a secure message. Here’s what you need to know and get writing if possible through SM.

1. YOU NEED TO KNOW YOUR DECEMBER STATEMENT CLOSE DATE AND YOUR SPEND AMOUNT. 2. YOU NEED NOT EXCEED YOUR SPEND AMOUNT UNTIL AFTER DECEMBER’S STATEMENT CLOSE.

Oh yeah, the reason you want to do this after the December close date is that the points will not post until your Jan. statement. making to eligible for 2018/19 Companion Pass.

Besides airline mileage/tickets, what else can the points be used for?

@Rose – You can redeem your points for gift cards, items, concerts, hotels, car rentals, etc. You can check it out here: https://www.1.awardhq.com/24468SWA0SWARR

Approved 10/2. Statement close date – Nov1st , Dec1st, Jan1st. If I hit the spend anytime after Dec 1st,

bonus posts in 2018? That correct? Maybe I request to change close date a couple/few days later to be safe? Thanks.

Anyone have a phone number to contact Chase Southwest business card to find out what happened to my 60,000 points? I need them to post before years end. Thanks for any info.

it’s on the back of the card

Would anyone have a phone number for the chase southwest business card (not the number on the back of the card) to find out why my bonus 60,000 miles were not posted to my account. Need the points before years end for companion pass. I called the number on the card. Answer I got was wait.

@Pete – That is the only number to call. The terms and conditions do state that it could take 6-8 weeks to be posted. With that being said it has always in the past posted 2-5 days after the statement close date. When is your statement close date? And when did you meet the minimum spend?

My first statement closing date was Oct 08 and I met the minimum with that statement. My wife and I always met the minimum on our other Southwest cards on the first statement and the bonus was always posted 2 days after statement I guess I’ll wait till next statement before calling again. Thanks

Have your points posted yet? My statement closes on Nov 4th and I’m hoping my points post a few days after that.

@Samuel – My points posted a few days after the statement closed. You should see the points post by November 10th the latest.

No points as of yet. I’m waiting for the second statement close to see if points are added.If not added to the phone I go.

60,000 points posted on my second statement. Made companion pass.

I signed up for 2 cards on October 1st, I just got a bill that says my closing date is October 19th and payment due November 16th. Which would make my 3rd month closing date December 19th and payment due January 16th. So will I get my points in December or in January when I pay the bill? Naturally I want the points in January so I will have 2 years on the companion pass.

Also does spend $2000 in first 3 months mean 3 actual months or 3 bills? If it is actual months I should not exceed the $2000 until after my closing date of December 19th but before December 1st?

@Joe – I suggest sending Chase a secure message through your Chase.com account to get the exact date where you must meet the minimum spend. The three months is actually 3 months (not 3 bills). With that being said, many people have been given 115 days from when they were approved, so find out your exact date.

What you need to do is not meet the minimum spend until AFTER your December closing dating, but PRIOR to your minimum spend expiration. If the minimum spend expiration is after January 1, 2018, I suggest just waiting until Jan 1 to meet the minimum spend.

I’m at 105,500 points what should I do?!

@Greg – Use the Southwest shopping portal? Have any big online purchases you need to make? Use your Southwest credit card + the portal and you could get there. But need to do it quickly.

Sometimes there are good bonus points when you book a hotel through southwest’s website. I’ve seen 4K points for a single night stay. Good luck!

Will the $69 annual fee automatically be applied to the card when you sign up for one?

@Mary – Yes, it appears in your first statement bill.

I’m @ 90,000 points, 20,000 from 110,000. I was denied the 60,000 card because I had applied & received a card within the last 12 mos. How can I get to the 20,000 needed, to obtain the pass again? I have purchased a new IPhone X through the portal & also a subscription which will be a total of 6700 points but I want to save for next year if I can’t hit 110,000 by end of year & post by end of year. ANy suggestions?

@nancy – it is now hard to earn those qualifying points since hotel transfers no longer count. A few suggestions – Do you have any large purchases you can prepay for with your Southwest card? Or can you pay some bills/mortgage/rent using Plastiq? They do charge a fee but few hundred dollars might be wroth it if you are going to save more money with the pass. Use the online shopping portal and resell items. I was able to recently get 4x points at Nordstrom. Holiday gifts? Just remember that shopping portal payouts could take up to a month to post. And any credit card charges need to happen prior to your December statement close date.

Yeah I just ordered Bose head phones for extra points but somehow I’m thinking I may not hit the mark. Oh well!

My southwest card close date is the 8th of the month. I have 4000 more points to get the companion pass again. Do I have to earn them by December 8th or do I have until Dec 31 and they then post on Jan 8. And points earned after 12/31 until 1/7 do not count for 2018.

@Chris – When do you want to earn the companion pass? It looks like in 2017 as 106,000 points have already hit your account in 2017? Is that correct?

If that is the case, you’ll want the 4,000 points to hit your Southwest account in 2017. If you are earning them via credit card spend, you want to spend that $4,000 by your statement close date (December 8, 2017).

Hi! I have a question I’m hoping you can help me with. I was able to sign up for both the premier and plus card when they had the 60k bonus. I waited until the last minute so I could hit my spending at the beginning of next year and have the companion pass for almost all of 2018 and then 2019. My card approval date was 10/3 so I “officially” have until 1/3/18 to hit my spending. My statement close date is the 4th of the month for both cards. So, my question is: if I hit my minimum spend sometime between 12/4 and 1/3, the points won’t show up on the Southwest system until after the 1/4 statement, correct? If I hit the minimum spend in December I just want to make sure they don’t actually get credited to Southwest until next year. But it sounds like like you’re pretty sure they won’t credit to Southwest until after the statement date? Thanks for any help you can provide!

@Michele – Yes, I am pretty sure they won’t credit to Southwest until a few days after your statement close date. But, I always suggest to wait until the end of December or even January 1 to cross that minimum spend threshold.

Hi. I’m at 102,000 points and just past the December billing cycle date. I know more credit card spending won’t earn me more points this year based on previous posts you’ve answered. Will booking additional flights/hotels for December use help for this year or am I too late to do more?

@Kevin – Yesterday I wrote a post on the ways to still earn points, so definitely check it out! If you stay at a hotel/fly this year then it will count. If you book now for stays/flight sin 2018 then it will not count.

I have a different problem. My husband met his spend on Nov 12 for the business card, already received the credit card statement. But the bonus miles and Companion Pass did not post to his Southwest account. Only the miles for the amount he spent got posted. When he called Chase, the first guy was clueless. He told us to call Southwest. Then when we called Chase again, another guy said the bonus and Companion Pass will post Dec 12. Today is Dec 12, I have yet see any of that in his account. Has this happen to any one before?

I used the same offer and already received my Companion Pass and bonus miles by the time the credit card statement came.

Here is the only uncertainty: I usually take screenshots of my applications including the promotion page. But I forgot to take the screenshot of the promo page for his application. I can’t remember if I originated the application through the promotion link. But subsequent screenshots of his application show the same URL with the same promo codes int the URL in my application screenshots. I assume since the URLs are the same between his and mine, we should be safe, right?

Has anyone taken a long time before getting their bonus and Companion Pass?

@Lisa – When is your statement close date? Also, are you 100% sure you met the minimum spend WITHOUT including the annual fee?

Hi! I had a question hoping you could help ease my mind! My statement close date was Dec 20. I just met my minimum spend today (without realizing I was that close). But since I’m after my December close date, I should be good and get the bonus points in January 2018, right? Do you know of any cases where they awarded bonus points based on date minimum spend was reached instead of statement date? I haven’t met the minimum spend on my business card yet bc I want to do that in January 2018 also but I want to make sure I don’t get my Premier in 2017 and Business in 2018 and split up my points so that I can’t get the CP. Thanks!

I got my credit card and earned 40k points. Unfortunately, a week later, Southwest offered 50k to new subscribers. I have a few questions. SW also gave me a companion pass. How does that work and does it expire? Can I only choose one person or switch them out? Do they have to be on my exact flight or can they live in another city.

@Chris – Send Chase a secure message and ask if they will match the sign up bonus. When did you earn the SW companion pass? In 2017 or 2018? If in 2017, then it expires December 31, 2018. If in 2018, then December 31, 2019. The Companion Pass allows another person to fly with you on the exact same flight for free plus taxes/fees. As long as there is a seat available you can add your companion onto your itinerary. You can change your companion three times per year.

I applied for the premier card and earned the bonus points in 2018. I applied for the business card in 2018 to earn enough points for the companion pass in 2019. My closing statement date is the 8th. I was $50 shy of hitting the minimum spending for the bonus points in Oct. If I spend enough to hit the minimum in Nov before my Dec closing statement. Will the bonus points hit my account in time to earn the companion for 2019?

Could I transfer the points from my premier card to my business card and close the premier card without losing points? I applied for one card in 2017 and another card in 2018. I’m trying to see if I can avoid paying for both cards in 2018.

@Kim – It sounds like you need to bonus points from the business card to still hit your account right? So you need to spend another $50? Go spend those $50 ASAP. The bonus points should hit your account a few days after your statement closes. So if your statement closes Dec 8th, they should hit your account around Dec 12th-ish.

You can close your Southwest cards without losing your points. They are directly in your Southwest account, so closing a card will have no impact.

Question! If I open the the credit cards this month (November 2018) and start spending on the card and my bonus points post in 2019 – those points count for 2019 and are not back dated or based on the date my account was opened? Just want to make sure I do this right! Thanks!

@Melissa – That is a great question! The points count when they hit your account and do not get backdated. So if they hit your account on January 1, 2019 or later, they could for 2019 regardless of when you opened the card.

Hello! My close date for both SW personal and business card is every 4th of the month. my first statement already came out last 12/4/18 I just hit the minimum spend yesterday 12/13/18 for both cards. Since my close date for this cycle is on 1/4/19 does it mean it will be posted 2 to 5 days after statement close date? For me it does not matter if its 2 to 5 days or 4 to 6 weeks as long it will be posted for next year 2019. I hope they wont post my welcome bonus during this current cycle.

@Ronald D – Theoretically it should post a few days after your January statement close date. I have never heard of a report of it posting within the cycle when minimum spend was made, but nothing is ever 100% guaranteed. My gut assumption is you will be okay!

I applied for 2 RR Rewards cards in December 2018. I have been using both cards and am slightly over minimum spend on one and not quite there on the other; however, is it safe to say that since my very first statement does not come out until the 3rd week in January, it really would not matter how much I put on it in December of 2018. All the spend and all the bonus points should show up in January of 2019 and once I spend an additional 6K I will obtain the coveted Companion Pass. Is that correct or am I actually in jeopardy because I went over the minimum spend on one of my cards in December? Thank you for your insight.

@Susan – The card that you went over the minimum spend on, was that post December 3rd? I personally would wait until January 1st just to 100% make sure nothing goes wrong, but theoretically you should be fine after your statement closes.

Hi, will any Credit Card spend ( December 7th statement closing date) from December 8th to January 8th, 2019 Post in January? Or does credit card spend post back to December transactions? I am referring to normal Credit Card spend points and not anything to do with the Chase Bonus.

Thank you!

@Sam – The credit card spend in December, post the statement closing date, should post a few days after your January statement closes. Thus will count towards your 2019/2020 Southwest Companion Pass.

Hi,

I reached the minimum spend a week before Jan 1st and it reset and I lost 40,000 points towards companion pass even though it said in their terms and conditions that it would take 6 to 8 weeks to post. Is there anyone I can talk to to help with this, or is all hope lost? I still have 20,000 extra bonus points pending but I think it’s impossible to rack up 90,000 remaining points to get the companion pass within the year. I am pretty distraught because I followed their terms.

@A O – It sounds like your statement closed at the end of December and then posted right before the New Year, is that correct? Although their terms state that, unfortunately that is not how it actually works in practice. I absolutely would call both Southwest and Chase and file a report to see if there is anything that can be done. I hate to be debby downer, but this has happened to a few readers in the past and they continued to get the runaround by both Chase and Southwest. Chase was putting blame on Southwest and Southwest was putting blame on Chase and ultimately no resolution. With that being said, I’d absolutely your hardest to see if anyone is willing to help.

I have a question about the timing of the anniversary bonus points for this card. I know that, depending on the version of the card, the Southwest credit card provides either 3,000 or 6,000 Rapid Rewards points upon the cardholder’s anniversary date. Do these points post before or after the new year’s annual fee posts? I would like to cancel the card after receiving all of my first year bonus points (i.e., the 65,000 points based on spend), but I’m willing to hang onto it until the anniversary bonus points post. Yet I don’t want to pay the next year’s annual fee. So do you recommend I cancel right away or wait until the anniversary bonus points post? It all comes down to the timing of when exactly the new annual fee kicks in. Thanks for your guidance.

How do you apply for 2 Southwest credit cards? Do I need to put one in my husbands name? Then how do you put the points together?

@Sue G – You want to apply for both personal and business in the same persons name.

How do I apply for two Southwest credit cards? Do I put one in my husbands name , if so then how do I put the points together?

@Sue G – You cannot pool Southwest points.