While the Chime Card rewards are no where near as good as Amex Offers, they just came out with some half way decent offers to allow you to save money on travel primarily (along with some other non-travel merchants)! With most of these offers you’ll essentially get 10% back on the minimum required amount to trigger the cash back.

What is a Chime Card?

For those new to this card, it is a debit card that gives similar type deals to the American Express Offers. By shopping at participating merchants with your Chime Visa debit card you receive money back and unlike Amex Offers you do not need to sync or register your card in advance. Although offers are limited so they are available as a first come first serve (although I have yet to see an offer reach its maximum quickly).

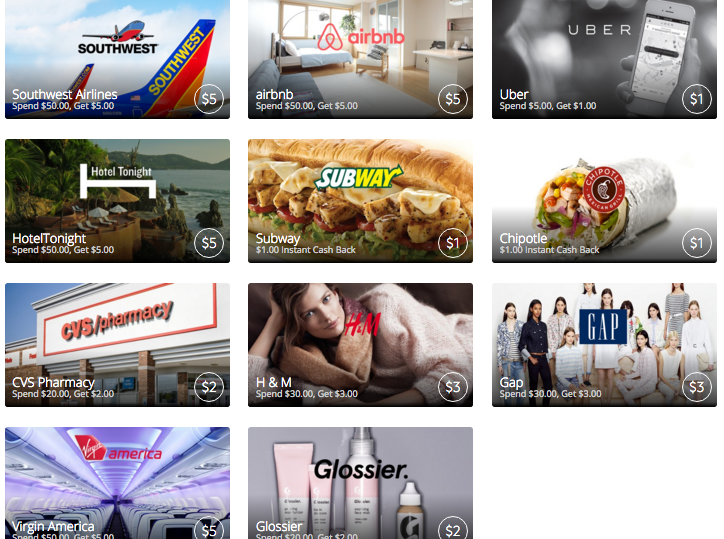

These offers are set to expire Saturday May 21, 2016 and include:

- Southwest Airlines – Spend $50, get $5 back

- Airbnb – Spend $50, get $5 back

- Uber – Spend $5, get $1 back

- HotelTonight – Spend $50, get $5 back

- Virgin America – Spend $50, get $5 back

- Chipotle – $1 instant cash (make any purchase at Chipotle regardless of price and get $1 back)

- CVS – Spend $20, get $2 back

- Gap – Spend $30, get $3 back

- Subway – $1 instant cash (make any purchase at Subway regardless of price and get $1 back)

- H&M – Spend $30, get $3 back

- Glossier – Spend $20, get $2 back

These are semi good deals depending on your purchasing needs. I personally will be purchasing a $50 Southwest gift card since I fly Southwest quite often and can use the gift card to pay for the taxes on my award flights. I’ll also be taking advantage of the CVS offer since I shop there quite often! Most likely the Uber, Gap, and H&M offer will be utilized as well on purchases I’d make anyways. Overall, a $14 savings for me. Nothing earth shattering, but still something. And over the course of the year it adds up.

New to Chime?

While you can find all details on the Chime card in this prior post, here is a synopsis:

- What is the Chime Card? A debit card where you must apply and enter your SS#. It is a soft inquiry, which will not affect your credit score.

- How do I apply? Apply here. If approved you will not be able to take advantage of any of the offers until your card comes in the mail. In the meantime, however, you can setup your account online, download the Chime app, and fund your card.

- How do I unload my money from the card? Use your card at any merchant that accepts Visa! You can also purchase gift cards, i.e., Amazon.com, if you want to get the money off fast to use for future purchases. You can withdraw your money at an ATM (up to $500/day) but there is a $2.50 fee per transaction on domestic ATMs. You might also incur a fee from the ATM provider directly.

- What are the fees for this card? If there is no activity on your card for 180 you will be charged $5. Activity can be as simple as a $1 purchase or a $1 transfer from PayPal, but there still needs to be some activity. A $5 fee can add up so make sure to remember this! This card comes with a 3% foreign transaction fee.

- How do I take advantage of the Chime offers? The main purpose of this card is to receive money back with participating offers, not to use at everyday merchants. When you see an offer, it will tell you how many are left. Surprisingly, not many people use Chime, so even if you see there are only 50 transactions left for that one offer, it could take weeks to meet. Before you shop though, make sure there are at least a few transactions left to ensure you will get the money back to your Chime account. Each offer is only available once per card. One thing to note – purchasing gift cards typically works to trigger the cash back. If online, just make sure you are purchasing through the store directly and not a third-party merchant (which is typically with eGift cards but not physical plastic gift cards).

Overall, I found the process with applying and using the card incredibly easy. While this is not a huge money making opportunity, I believe I will save about $100-$200 over the course of the year. Not so bad for hardly any effort!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.