Plastiq is an awesome way to earn points and miles by using a credit card to pay bills where you typically couldn’t use a credit card to pay direct. These bills include rent, car loans, utilities, school tuition, taxes etc. Note: Visa and Amex do not allow you to pay your mortgage through Plastiq, although MasterCard Discover allow this payment. While using this bill payment system is great, there is a fee where it may or not be worth it – typically a 2.5% fee.

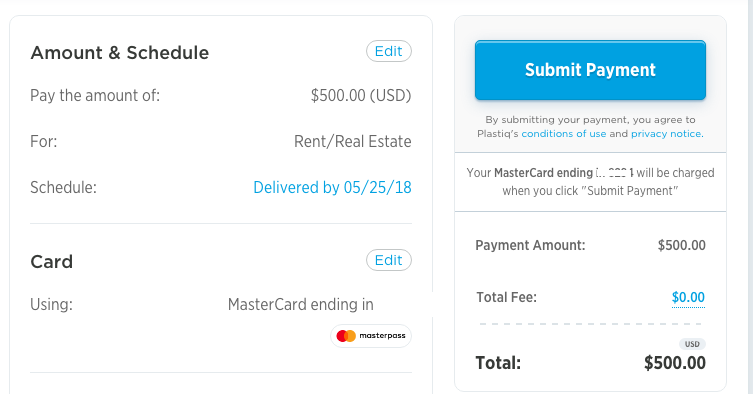

With that being said, there is currently a promotion where they are waiving all fees if you pay with a MasterCard via Masterpass! This means you can pay your mortgage (or any other bill) through this promotion with no fee! Each payment is capped at $500, but there seems to be no maximum to the number of payments you can make. Typically the fee would be $12.50 on this $500 payment, but it will now be $0! And depending on how many bills you have to pay, this could save you a good amount of money on fees! This offer is valid until September 30, 2018. Note: You must have already made $500 in payments to be eligible for this offer. So if you are new to Plastiq you’ll need to make a $500 payment first (and pay the fee) and you can then take advantage of this promotion.Â

Using Masterpass with Plastiq

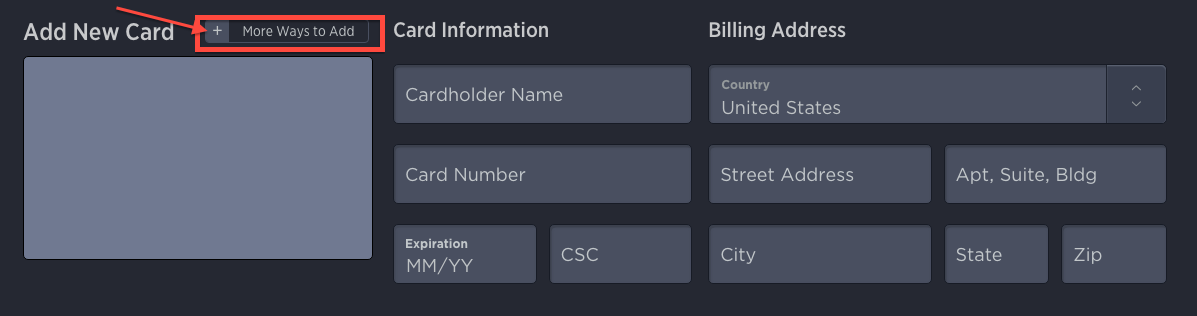

After you enter your payee information and the amount you want to pay (no more then $500), you are able to select an existing credit card or add a new credit card. Add a new credit card and click on the “More Ways to Add” button.

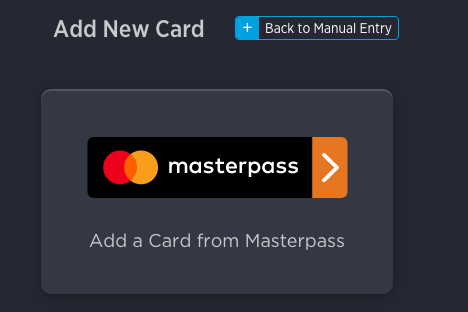

You can then select the Masterpass option.

Sign into your Masterpass account (or create a new account) and add your MasterCard information. Select your MasterCard as your form of payment and you’ll see that your fee has dropped to $0.

Since this is limited to just MasterCard’s, pick the MasterCard that provides you with the most value – whether it be points or cash back. I only have two MasterCards – JetBlue and IHG. JetBlue points are worth way more then IHG points so I personally used my JetBlue credit card.

If you do not have a Mastercard or prefer to earn Chase Ultimate Reward points instead, remember, you can still earn 3x points by using your Chase Ink Preferred credit card. While you will still pay the 2.5% fee (since it is a Visa and not a Mastercard), the 3x points earned outweighs the fee you pay. You can learn more about this here.

My Experience with Plastiq Overall

I’ve been using Plastiq for over a year now to pay anything from preschool tuition, my mortgage, my accountant, etc. There were times last year when I used my Southwest credit card so I could earn points for the Southwest Companion Pass, but primarily I’ve been using my Chase Ink Preferred due to the 3x points. Now, I will exclusively use my JetBlue card until the promotion is over (or pulled).

I have personally never had any issues with bills not being sent/received, but I always suggest keeping a close eye on it to ensure payment is received. I find Plastiq to be extremely easy to use, especially for merchant that is already saved to your account. Typically bills take about a week to be received by the merchant.

New to Plastiq?

Now, if you are new to Plastiq there is a referral program where you can earn FFDs (Fee Free Dollars) towards your payments. After your first payment(s) totaling $500 or more, you’ll earn $500 in FFDs. That means on your next $500 in payments you will not pay a fee at all! This is regardless of the credit card you use to pay. You must sign up for Plastiq through a referral and then you can go ahead and use your referral link to get friends/family members to sign up.

Thanks to Miles to Memories for sharing this promotion.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I also have the jet blue and ink preferred. Isn’t the Ink preferred still a better deal given the 3x points (albeit with the 2.5% fee)?

@Steve – It depend son how you value your points, BUT, the big difference is that you can pay your mortgage with JetBlue (since it is a Mastercard) and you cannot with Chase Ink (because it is a Visa).

Sorry if this is a dumb question. My son’s University charges a 2.5% credit card fee when paying tuition. If I were to use Pladtiq to pay tuition would the school look at this as a credit card purchase and still charge me the fee or is it the same as me sending a check? Thanks

It is the same as sending a check.

Evan,

I believe Plastiq will send a check for the tuition, so they will credit it as a check received. Only the first $500 of each transaction is fee-free for this promotion, though.

@jennifer & evan – that is correct. Plastiq sends a check for the tuition. The college will not charge you an additional fee.