UPDATE: This offer has expired.

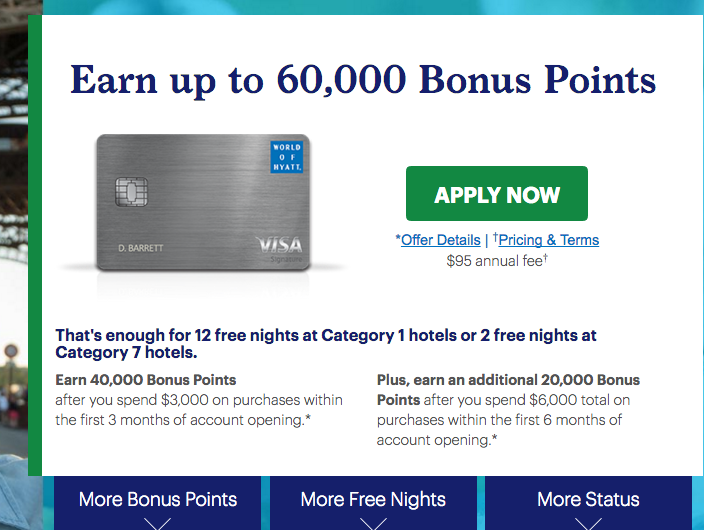

Last week Hyatt announced a new credit card, the World of Hyatt Credit Card, where you can earn up to 60,000 points! A great sign up offer for this card, although with a slightly higher annual fee then the previous version of the card – $95/year.

While this is a great card to add to your wallet, they are limiting who is eligible. Since this card is replacing the previous version of the Hyatt credit card, if you’ve have or have had the previous version you might NOT be eligible. The terms state:

The product is not available to either (i) current Cardmembers of any Hyatt Credit Card, or (ii) previous Cardmembers of any Hyatt Credit Card who received a new Cardmember bonus within the last 24 months.

This means if you currently have the existing card, you can do one of two things:

- Cancel your card and apply for the new card. This only applies to those that received the sign up offer for the old card more then 2 years ago.

- Upgrade to the new card. While you will not receive the 60,000 sign up bonus points, it seems like Hyatt will give you 2,000 bonus points for upgrading.

Now if you no longer have the Hyatt credit card but have received the bonus within the past 2 years, you’ll need to wait till the 2 year mark to apply for the new card.

Fortunately though, this card is also not subject to Chase’s “5/24†rule (yet!), so this is a great card for those who cannot apply for any more Chase cards due to the rule. Although it will count against your “5/24†count if you are looking to apply for more Chase cards in the future.

Bonus Offer Details

This offer will allow you to earn up to 60,000 bonus points which is extremely generous and much higher then the previous credit card welcome offer.You can read more about the benefits of this card, such as a more bonus points, more free nights annually, and earning status easier, here.

- Earn 40,000 bonus points after you spend $3,000 on purchases within the first 3 months of account opening.

- Earn an additional 20,000 bonus points after you spend $6,000 total on purchases within the first 6 months of account opening.

Disclosure: This post contains affiliate links. As always, thank you for supporting Deals We Like and enjoy traveling on a deal!

Disclosure: This post contains affiliate links. As always, thank you for supporting Deals We Like and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

What’s the recommendedminimum wait time between cancelling and submitting a new application?

I’ve heard 30 days, but hopefully there are more data points upcoming.

I had same question. My wife and I have had the regular Hyatt card for well over 24 months and don’t mind cancelling and re-applying for the new version. I have visions of 120k Hyatt points at our disposal swimming around in my head… 🙂

I cancelled my old Hyatt Visa last week (thursday or friday). As of exactly July 1st, it was 24 months since I received the 2 free nights. I was immediately approved. Had 7/24 but hadn’t opened a personal card in 6 months. Hope my data point helps.

Oh, and to add, I just applied for new card today 7/3

@PJ – Thank you for that data point!

@Tyler – I typically suggest 30 days, but another reader applied only a few days after canceling and was approved.

@John – I typically recommend 30 days, but a reader just commented saying they applied only a few days after canceling and was approved.