UPDATE: This offer has expired.

Whether you are up in the air traveling or grounded right now, you are probably day dreaming about your next vacation. Regardless of your situation, it’s the perfect time to work on building your account balance. And with Delta’s newly launched limited time welcome bonus offer, you can easily earn up to 90,000 bonus miles. In fact, we’ve never seen bonuses higher than the current offerings.

Personal cards:

- Delta SkyMiles® Gold American Express Card: Limited Time Offer — Earn 70,000 Bonus Miles after spending $2,000 in purchases on your new Card in your first 3 months. Offer expires 11/10/2021. Terms Apply. See Rates and Fees

- Delta SkyMiles® Platinum American Express Card: Limited Time Offer — Earn 90,000 Bonus Miles and 10,000 Medallion® Qualification Miles (MQMs) after you spend $3,000 in purchases on your new Card in your first 3 months. Offer expires 11/10/2021.  Terms Apply. See Rates and Fees

- Delta SkyMiles® Reserve American Express Card: Limited Time Offer — Earn 80,000 Bonus Miles and 20,000 Medallion® Qualification Miles (MQMs) after you spend $5,000 in purchases on your new Card in your first 3 months. Offer expires 11/10/2021. Terms Apply. See Rates and Fees

Business cards:Â

- Delta SkyMiles® Gold Business American Express Card: Limited Time Offer — Earn 70,000 Bonus Miles after spending $2,000 in purchases on your new Card in your first 3 months. Offer expires 11/10/2021. Terms Apply. See Rates and Fees

- Delta SkyMiles® Platinum Business American Express Card: Limited Time Offer — Earn 90,000 Bonus Miles and 10,000 Medallion® Qualification Miles (MQMs) after you spend $3,000 in purchases on your new Card in your first 3 months. Offer expires 11/10/2021.  Terms Apply. See Rates and Fees

- Delta SkyMiles® Reserve Business American Express Card: Limited Time Offer — Earn 80,000 Bonus Miles and 20,000 Medallion® Qualification Miles (MQMs) after you spend $5,000 in purchases on your new Card in your first 3 months. Offer expires 11/10/2021. Terms Apply. See Rates and Fees

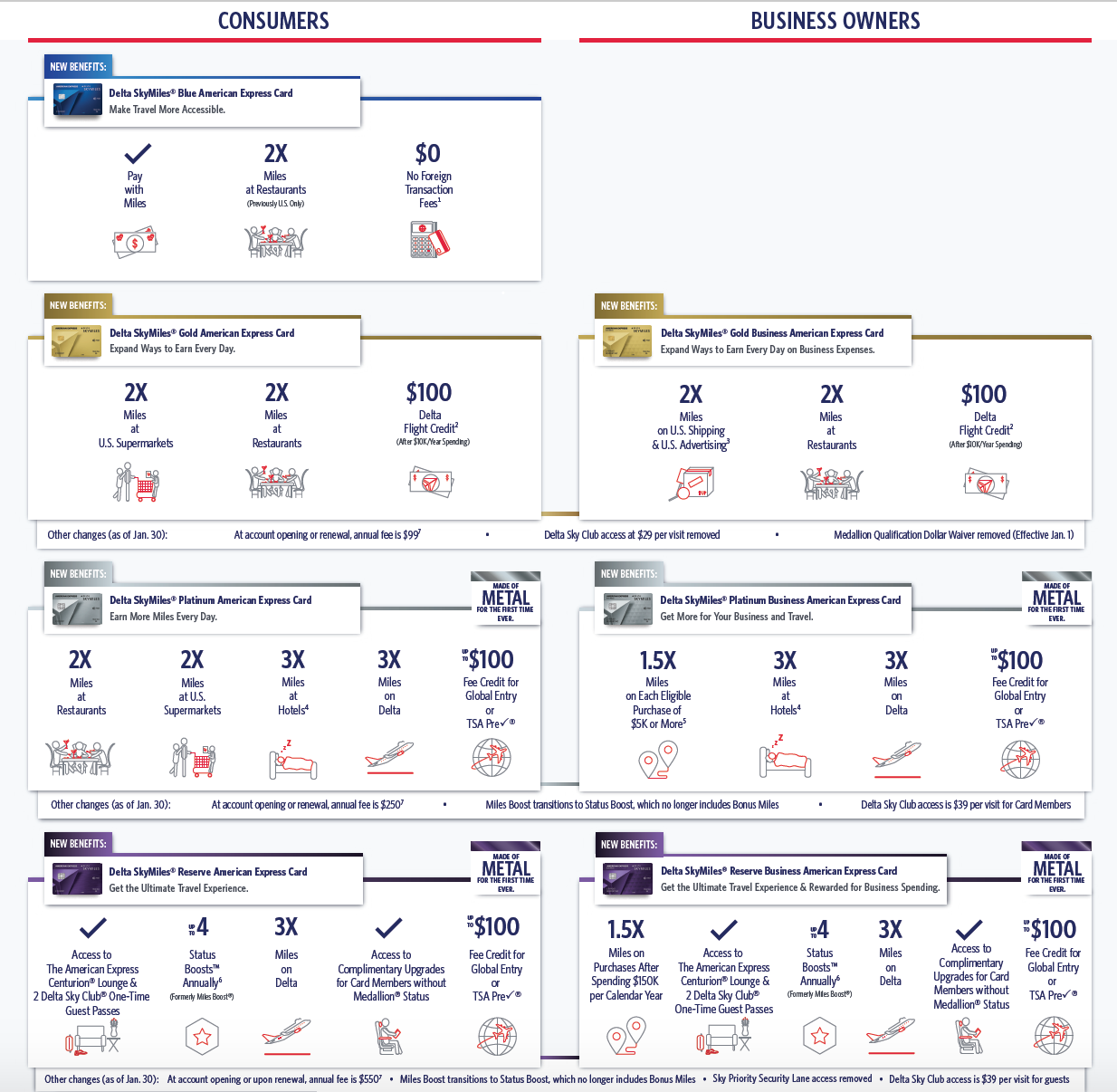

Card Benefits

Not only do the cards offer an all-time high offer, there are many benefits to having one of these cards in your wallet.

And, with all American Express cards, even though you are only allowed to receive the offer once in a lifetime, all seven cards are treated separately. This means you can still apply for another card within the suit. For example, if you already have the personal version you are still eligible for the business version; have the Gold, apply for the Platinum.

Free checked bags

With the Gold, Platinum and Reserve card, you’ll receive your free checked bag for both you and 8 other passengers on the same itinerary. Additionally, you’ll receive Priority boarding, 20% in-flight savings and discounted SkyClub access — this extends to the additional passengers on the itinerary as well. (The Blue card does not come with these benefits).

I personally find those benefits pretty basic, but the free checked baggage can really save you some money depending on how you fly.

Earn Medallion Qualification Miles (MQMs)

With the Delta Platinum card only, every year you are a cardmember, you are able to earn 10,000 MQMs for the first $25,000 in spend on the card during the calendar year, up two times per year. This will help you get one step closer towards status (up to 20,000 MQMs per year). And with the 2021 status boost, you’ll receive a 25% bonus on the points earned, resulting in 12,500 MQMs.

With the Delta Reserve card only, you’ll also be able to earn additional MQMs, but even more than the Platinum card benefit. With this card you are able to earn 15,000 MQMs after you spend $30,000 in purchases on your card during the calendar year, up to four times per year. If you are a big spender, this can truly help you earn the desired status (up to 60,000 MQMs per year). Again, with Delta’s status boost promotion, in 2021, those 15,000 MQMs will actually result in 18,750 MQMs.

Annual companion ticket

With the Delta Platinum card only, you’ll receive an annual companion certificate which can be used within the 48 contiguous United States. You’ll only pay the taxes and fees.

With the Delta Reserve card only, you’ll also receive an annual companion ticket on your account renewal, but it will be valid for any cabin class (including first class).

Related: Here is everything you need to know about the Delta Companion Ticket.

Maximize your Delta miles

If you fly Delta often, you’ll want to get the card that will earn you the most number of miles on your flight. Both the Platinum and Reserve card (personal and business) will earn you 3x miles while the Gold card (personal and business) will earn you 2x miles.

On the Delta Platinum Business card, you’ll also earn 1.5 miles per dollar on single eligible purchases of $5,000 or more, up to 50,000 additional miles per year. If you make large purchases, this can definitely add up.

On the Delta Reserve Business card, you’ll earn 1.5 miles per dollar after you spend $150,000 on your card in a calendar year. (Eligible purchases after spending $150,000 do not include Delta purchases).

Flight credit

With the Delta Gold card only, you’ll receive a $100 Delta flight credit after you spend $10,000 on the card per year.

This is a new benefit for both the personal and business version of this card.

Fee Credit for Global Entry or TSA Pre✓®

Both the Delta Platinum and Reserve card (personal and business) will give reimburse the fee paid for Global Entry ($100) or TSA PreCheck ($85). Even if you already have one of these two perks, you can always pay for a friend or family members application and it will still trigger the statement credit.

Airport Lounge access

With the Delta Reserve card (personal and business), if you are flying on a same-day Delta-marketed or Delta-operated flight, you’ll receive complimentary Delta Sky Club access and access to the American Express Centurion Lounges.

MQM waiver

If you are only able to earn Delta status on miles flown and not the Medallion Qualifying Dollar (MQD) requirement, having the Delta Platinum or Reserve card will help you out. If you spend $25,000 in a year on the card, you’ll receive a waiver for the MDQ requirement.

Amex Offers

Since all are American Express cards, you are eligible to take advantage of the many American Express statement credit offers that I write about often! This can help often the annual fee and help you save money!

With many different cards, which card is best for you?

So while all three cards have similar benefits, the Platinum and Reserve card have some extra benefits — which makes sense due to the higher annual fees. One main reason to get the Delta SkyMiles® Platinum Credit Card from American Express or Delta SkyMiles® Platinum Business American Express over the Gold card is if you are looking to earn additional MQMs to earn status. That is if you are able to put that much on your card. Also, the Platinum card comes with an annual companion certificate upon account renewal and paying the annual fee (domestic economy class that can be used within the 48 contiguous states + you have to pay applicable taxes/fees).

Now, with the Delta SkyMiles® Reserve® Credit Card from American Express and Delta SkyMiles® Reserve Business American Express you are getting the same benefits as above, but the opportunity to earn even more MQMs in a year. If you are able to earn the maximum 60,000 MQMs solely from the Status Boost credit card spend, then this will get you automatic Gold status (which only requires 50,000 MQMs). However, Platinum and Diamond status are more ideal statuses which requires 75,000 and 125,000 MQMs earned within the calendar year. If the only way you’ll be able to earn one of these two statuses is with credit card spend combined with actually flying on qualifying flights, then this is a great benefit. The other big perk of the Reserve card is that the annual companion certificate can even be used in first class and you’ll receive complimentary Global Entry or TSA PreCheck.

With all that being said, if you are just looking for the basic perks and a good limited time bonus, then the Delta SkyMiles® Gold Credit Card from American Express or Delta SkyMiles® Gold Business American Express might be your best bet. The annual fee is waived for the first year, you’ll still receive a high welcome offer, you’ll get to check your bag for free and you’ll receive priority boarding.

For rates and fees on the Delta SkyMiles® Gold American Express, please click here.

For rates and fees on the Delta SkyMiles® Platinum American Express, please click here.

For rates and fees on the Delta SkyMiles® Reserve American Express, please click here.

For rates and fees on the Delta SkyMiles® Gold Business American Express, please click here.

For rates and fees on the Delta SkyMiles® Platinum Business American Express, please click here.

For rates and fees on the Delta SkyMiles® Reserve Business American Express, please click here.

Disclosure: This post includes affiliate links. As always, thank you for supporting the blog and enjoy traveling on a deal!Â

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.