UPDATE: This offer is no longer available.Â

Earlier this year, Chase introduced a new Marriott co-branded card — The Marriott Rewards Premier Plus Credit Card. Unfortunately though, when they launched the card they were not allowing current Marriott Rewards Premier cardmember or those who have received a new cardmember bonus within the past 24 months to apply. You either had to cancel your card and apply for the new card (assuming it was 24+ months since you received the bonus), or upgrade. While Chase is typically not very giving when it comes to upgrade offers, for this particular card, Chase was being extremely generous. Upgrading a card also has its benefits in that you keep your credit history and it does not count as a new application — thus does not hit your credit or count against your Chase “5/24” status. You can check your offer here by entering your name and last 4 digits of your card number. You are able to check your offer without actually committing to the upgrade.Â

Earn Bonus Points for Upgrading Your Card

When the offer was initially rolled out, I received an offer of 20,000 points for upgrading my Marriott credit card. This was actually the first points and miles credit card I applied for right out of college so I definitely did not want to cancel the card. Although I wasn’t particularly excited about my personal upgrade offer, especially when some card members were being offered up to 50,000 points.

One other reason I didn’t want to upgrade at the time was because I was mid-cycle from earning my free night certificate from the card. If I upgraded the card that would reset my cardmember annual cycle, and instead of receiving the free night in certificate in November 2018, it wouldn’t hit until May 2019. So I waited until November to actually upgrade my card and to my surprise, my offer actually increased to 50,000 points! At 50,000 points, this was absolutely an offer I was willing to take, especially since it only required me to make just one purchase on the card to earn the points — no thousands of dollar minimum spend required!

Canceling the card and applying for the new version of the card absolutely would NOT have made sense. While I am giving up 25,000 points, it is worth it to not have to cancel my card, apply for a new card, spend another $3,000, have another hit on my credit report, and add to my Chase 5/24 status (which I only have one slot left in for a new card!).

The upgrade offers expire December 31st, so definitely check your offer to see how many points you can earn. Of course the new card costs an extra $10 a year, but there are definitely better benefits that are well worth it.

Card Differences

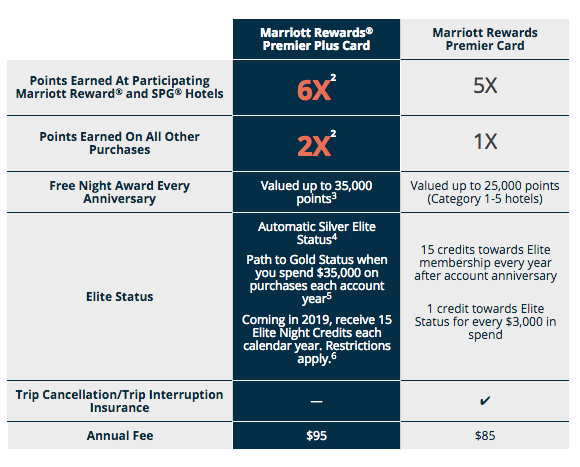

Note that there are some decent differences between the two cards. I personally think the new card is better, but here are the pros and cons of the new card:

Cons:

- Annual fee increase: The new card now costs $95 a year where the previous version was only $85 – so a $10 difference.

- No trip insurance: The new card also does NOT carry that trip cancellation/trip interruption insurance. For me, that is a huge con, but I have many other Chase cards that carry that same insurance so I am fine forgoing it. Many Chase cards (the ones that cost an annual fee) carry travel insurance in case you need to cancel a trip for a approved reason, flight is cancelled/delayed, etc.Â

- No more nights towards status on spend: With the current version of the card you’ll earn 1 night towards status for every $3,000 you spend on the card. For some, just being able to earn a few more nights towards status per year is huge and will get them to the next status level. **This will be the only Marriott and Starwood card that carries this benefit, so consider this benefit strongly if you are considering upgrading.**Â

Pros:

- Earn more points for your credit card spend:Â The new card will earn 6x points for spend at a Marriott and Starwood hotel and 2x points on all other purchases. The current version of the card is one that sat in the back of my wallet year after year since the points earned were nothing so special. This now brings the card to be semi-competitive, although it is still not a card I’ll use for everyday spend.

- Better free night certificate: The free night certificate that you receive year after year with the new card can be used at a property that costs up to 35,000 points where the current card certificate can only be used at a property that costs up to 25,000 points. This is a huge difference – there will be many great 35,000 point properties, where the 25,000 point properties are just decent. NOTE: As I mentioned above, if you upgrade, it will alter the month of when you receive your annual certificate. Since my annual fee just hit in November, applying now after the annual fee hit was the best timing for me.

- Earn Gold status by spending on the card: If you spend $35,000 on your card within each account year, you’ll receive automatic Gold status. Earning Gold Elite status will be easier this way then the 1 night per $3,000 spent that you receive with the current card, but if you are trying to earn Platinum or Platinum Premier status, the old version of the card will help you more.

For me, the biggest difference is the free night certificate. Being able to use it at a much higher hotel category will provide more value for me year after year.

For me, the biggest difference is the free night certificate. Being able to use it at a much higher hotel category will provide more value for me year after year.

What is your plan? Did you upgrade? Or will you upgrade?

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Did you get your free night certificate for November? Did it post before you upgraded and if so how long after the anniversary date did it post.

@Shari – It posted to my Marriott account on November 11th. The annual fee hit my credit card December 1st. I did not upgrade until December 3rd.

Two Chase reps told me that upgrading would not impact the anniversary date or the date on which the free-night cert is issued.

@ti – Interesting, I was told otherwise. Did you upgrade and how did it work out?

I have the SPG Amex, but I was curious about the Chase upgrade page working for other co-branded cards – typing in my IHG info led me to a lame 5k upgrade offer. And they had no offer for my old hyatt.

@FeelsGood – Yes, it is a “catch all” page so there are some other cards it works for, but some of them are pretty poor, such as IHG and Hyatt.

Do you know if anyone has seen a decent offer for the CSP -> CSR upgrade? (I’m thinking of dropping to the CSR after my yearly travel credit to recoup a decent portion of the huge annual fee but might upgrade in the future if it makes sense. )

i am getting no response but to try later when we input the info for me and my wife

Link to auto-check upgrade status pulls up the page, but upon submitting valid info, generates this message: “We are sorry. We are unable to process your request at this time.”

October 31, 2018, I applied for the 100,000-point Starwood Preferred Guest American Express Luxury Card with $450 annual fee and 50k points each anniversary. The AMEX representative reviewed the terms and conditions with me and looked at my past records and stated I would be eligible. I told him I had had the Chase VISA Marriott Rewards Premier 80k points in Jun 2016 and AMEX SPG in July 2015 and the Chase Marriott Rewards Premier Business credit card 80k in August 2015. I was told I am eligible because I have not had the Starwood Preferred Guest American Express Luxury Card which has a $450 annual fee. I applied online and was approved instantly (there was no warning message during my application I was not eligible). A called AMEX a couple of weeks after I received my card and they assured me again if I spent 5K in 3 months I would receive 100,000 Marriott points. I called AMEX after approximately 75 days and AMEX confirmed I had met the 5K spending requirements and would receive the 100,000 bonus points in a couple of weeks. A month passed so I called AMEX for a status. I was rudely told I have a “Welcome offer history” and would not explain any details. I spoke to a supervisor and they stated AMEX can deny for any reason and this is what they exercised. I was told it could be because I abused points or took points and cancelled the card. I told her I have always try to follow the rules and even called in ahead of time to ask AMEX if I was eligible.

I asked appeal and asked for their corporate office address and process to appeal. A few minutes later I called AMEX again in hopes to speak to a more courteous supervisor. I spoke to another supervisor Matt. He was very nice and could not figure out why I was declined either but could only speculate. The only thing he could think of is AMEX and Chase have recently got together on the Marriott/SPG merger and are trying to root out churners. He went on to say this is a new policy only in the past couple of months and AMEX is trying to work out the details on how to stop churners. He stated he would file a case on my behalf but stated he has never seen one overturned. He agreed I did everything right. This is contrary to what I have read about AMEX “warning” users if they are not eligible. The same thing happened to me back in Sep 2016 when I applied for the AMEX Delta Gold SkyMiles card 50k for $2k spend. Only “after” I spent the $2k was I told the limit is once per lifetime and never received the bonus. Any ideas what options I have in this case? This seems difficult to every trust AMEX for any reason.

@Erick – I am so sorry this has happened. Unfortunately, Starwood/Marriott did put in place rules on August 26th where if you had certain card you would not be eligible for the other cards. https://dealswelike.boardingarea.com/2018/07/28/marriott-marriott-and-starwood-credit-card-applications/ . With that being said, the representatives should have been aware, although I am not surprised that they weren’t. In regards to the Delta offer, typically Delta applications and most other Amex credit card applications has wording in the T&C that you are not eligible if you’ve received the welcome offer in the past. Many times you have to read such fine print to know. I hope you get the points posted to your account. Good luck!!