UPDATE: This offer has expired.

About 6 months ago, Hyatt launched a brand new credit card — The World of Hyatt Credit Card. This card costs $20 more than the existing card, but came with many new and improved benefits, as well as a very generous bonus offer. Unfortunately though, I was just informed that this 60,000 point offer is coming to an end on January 9, 2019. Starting on January 10, 2019, the card will only offer 50,000 points for the exact same minimum spend. If you’ve been meaning to apply for this card, then make sure to apply soon and not leave an extra 10,000 points on the table!

Current Bonus Offer

The World of Hyatt Credit Card will allow you to earn up to 60,000 bonus points which is an extremely generous offer and much higher then the previous credit card welcome offer. This is actually the best offer to date and I personally do not foresee it going any higher.

- Earn 40,000 bonus points after you spend $3,000 on purchases within the first 3 months of account opening.

- Earn an additional 20,000 bonus points after you spend $6,000 total on purchases within the first 6 months of account opening.

What is 60,000 Points Worth?

Hyatt points are extremely valuable and I am always able to get at least a 2 cents per valuation. This means that I am able to get at least $1,200 worth out of my points by staying at Hyatt hotels. Some examples on where you can redeem your Hyatt points:

- 3 nights at the Grand Hyatt Baha Mar, Bahamas (rooms are 20,000 points per night and during peak times can be well over $400+ per night, and when you use points you do not have to pay the outrageous taxes or resort fees)

- 4 nights at the Andaz Costa Rica Resort at Peninsula Papagayo (room are only 15,000 points per night and throughout the entire winter can easily run $700 per night — this hotel is by far one of my favorite Hyatt redemptions!)

- 4 nights at the Hyatt Regency Coconut Point Resort and Spa in Bonita Springs, Florida (rooms are 15,000 points per night and this newly renovated property now includes a ton of water slides!)

- 12 nights at the Hyatt Place Ft. Myers, Florida (rooms are only 5,000 points per night and during peak times can easily be over $200 a night — you are also a quick drive away from some great west coast beaches in Florida)

- 4 nights at 2 different Boston hotels, the Hyatt Regency Boston and the Hyatt Regency Boston Harbor (rooms are both properties are only 15,000 points per night which is great during peak times)

- 5 nights at the Hyatt Place Long Island City / New York City (rooms are only 12,000 points per night which is half the price of most NYC properties and you are a quick subway ride away from Grand Central Station)

- 2 nights at the Park Hyatt Maldives Hadahaa (rooms are 25,000 points per night, but when they usually sell for $1,000 or more, this is a great way to use your points for a villa in the Maldives!)

- 3 nights at the Hyatt Centric Park City (rooms are 20,000 points per night and during the winter can go for over $700 a night due to it’s ski in/ski out location!)

- 7 nights at the Hyatt Place Salt Lake City Cottonwood (rooms are only 8,000 points per night and is located at the base of Cottonwood Canyon — perfect for your Utah ski trip)

Of course there are many many other properties within the Hyatt umbrella, but above are just some great examples!

Card Benefits

More Bonus Points

This card has very different (and better!) benefits then the previous Hyatt credit card. With this card you’ll earn more points on purchases at Hyatt hotels and for staying fit.

- Earn 4x bonus points at Hyatt hotels (previous card offered 3x bonus points)

- Earn 2x points on local transit and commenting purchases, including taxis, mass transit, tolls, ride-share services (the previous card did not offer any bonus points for this category)

- Earn 2x points at restaurants, cafes, and coffee shops (same number of bonus points as the previous card)

- Earn 2x points on airlines tickets purchases directly from the airline (same number of bonus points as the previous card)

- Earn 2x points at fitness clubs and gym memberships (the previous card did not offer any bonus points for this category)

This is by far the best card to use for paying for your hotel room at Hyatt properties and still a good card to use on all the other category bonuses. I personally will be using this card a ton in 2019 as it will help me earn Globalist status, but more on that below!

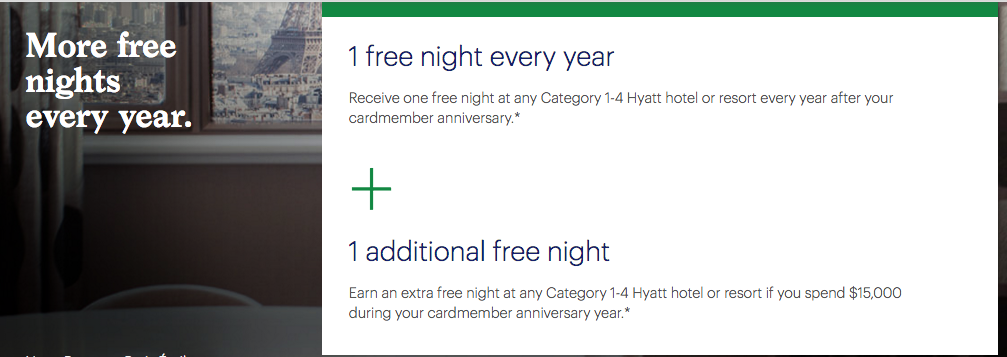

Free Nights

This is one of those cards where the benefits received on an annual basis pays for the annual fee, plus more! With this card, you’ll earn a free night certificate for a category 1-4 property every single anniversary. The certificate is valid for 12 months and can be redeemed for many of those properties I listed above, i.e., Andaz Costa Rica Resort at Peninsula Papagayo, Hyatt Regency Coconut Point Resort and Spa, Hyatt Regency Boston, etc. I personally put a conservative value of $250 on the free night certificate, but when used at certain properties can easily be worth $500-$750! The free night certificate absolutely pays for the annual fee, even if you aren’t using it at some of the top resorts.

In addition to the annual free night certificate you receive, if you spend $15,000 on your card in your cardmember anniversary year (not calendar year), you’ll earn an additional free night certificate (still valid for a category 1-4 night certificate).

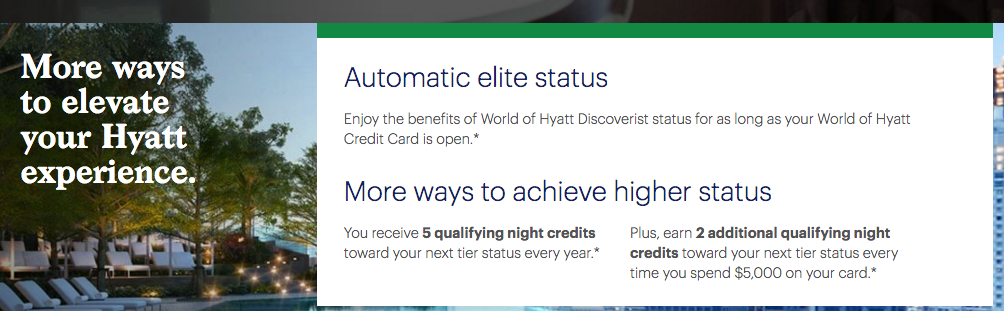

Earn Status Easier

With this card you’ll automatically earn Hyatt Discoverist status, but you’ll now have the chance to earn a higher status with your credit card spend. This is quite possibly my favorite benefit of the card as it will allow my family to earn Globalist status, which is by far my preferred status to have for my family!

With this card, you’ll automatically earn 5 elite qualifying nights towards status every single year. Additionally, for every $5,000 you spend on this card, you’ll earn an additional 2 qualifying night credits. This means you can actually earn Explorist or Globalist status without even stepping foot into a Hyatt hotel all year! For many, this will allow them to earn their Hyatt night stays with their credit card spend earned nights to earn a higher and more useful status.

- To earn Explorist status (mid-level tier) you must earn 30 qualifying nights a year, so with this card you’d only have to complete 25 nights at Hyatt properties.

- To earn Globalist status (top tier level) you must earn 60 qualifying nights a year, so with this card you’d only have to complete 55 nights at Hyatt properties.

Hyatt also just introduced milestone benefits, so the more you spend on the card, the more perks you’ll receive as well!

Who Is Eligible?

Since this card replaced the pervious version of the Hyatt credit card, only those who do not currently have the card and have not received a sign up offer in the past 24 months are eligible. This means you cannot have both versions of the card, unfortunately. If you currently have the existing card, you can do one of two things:

- Cancel your card and apply for the new card. This only applies to those that received the sign up offer for the old card more then 2 years ago.

- Upgrade to the new card. While you will not receive the 60,000 sign up bonus points, it seems like Hyatt will give you 2,000 bonus points for upgrading — nothing so great in my opinion.

Unfortunately it seems like this card is now subject to Chase’s “5/24” rule. While this has not been confirmed by Chase, many data points out there show that this is now the case.

My Thoughts

I personally think The World of Hyatt Credit Card is worth it for these reasons: 1) the generous sign up offer, 2) the annual free night certificate, and 3) the opportunity to earn a higher status. While the free night certificate is capped at a category 4 property, I’ve always come out ahead by using my free night certificate that is worth more then the annual fee. I love having cards where there is an actual tangible benefit for keeping the card year after year — for me the free night certificate does just that.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Amazing post ! Thank you for sharing this post.

I still have the old Hyatt card. How long do you recommend waiting to apply after cancelling old card ? Thank you.

@Beechy – Many people will say ideally wait 30 days, but I have read many reports of folks who were able to cancel and then apply (and be approved) the next day.

Awesome, thanks!

If you have the old Hyatt card can you get the new card and the bonus? or do you need to cancel the old one first?

@Robert – You need to cancel the old card first.