UPDATE: This offer has expired.

Southwest recently announced an increased welcome offer for all three of their personal credit cards. It is actually their highest offer we’ve seen to date for these particular cards. Since all three cards are offering the same “up to 75,000 point bonus”, you might be asking yourself which card to get. They all are similar in nature, but have slightly different perks and benefits. These differences might sway you one way or the other. Not only that, if you are able to earn the full offer, that will get you more than halfway towards earning the amazing Southwest Companion Pass.

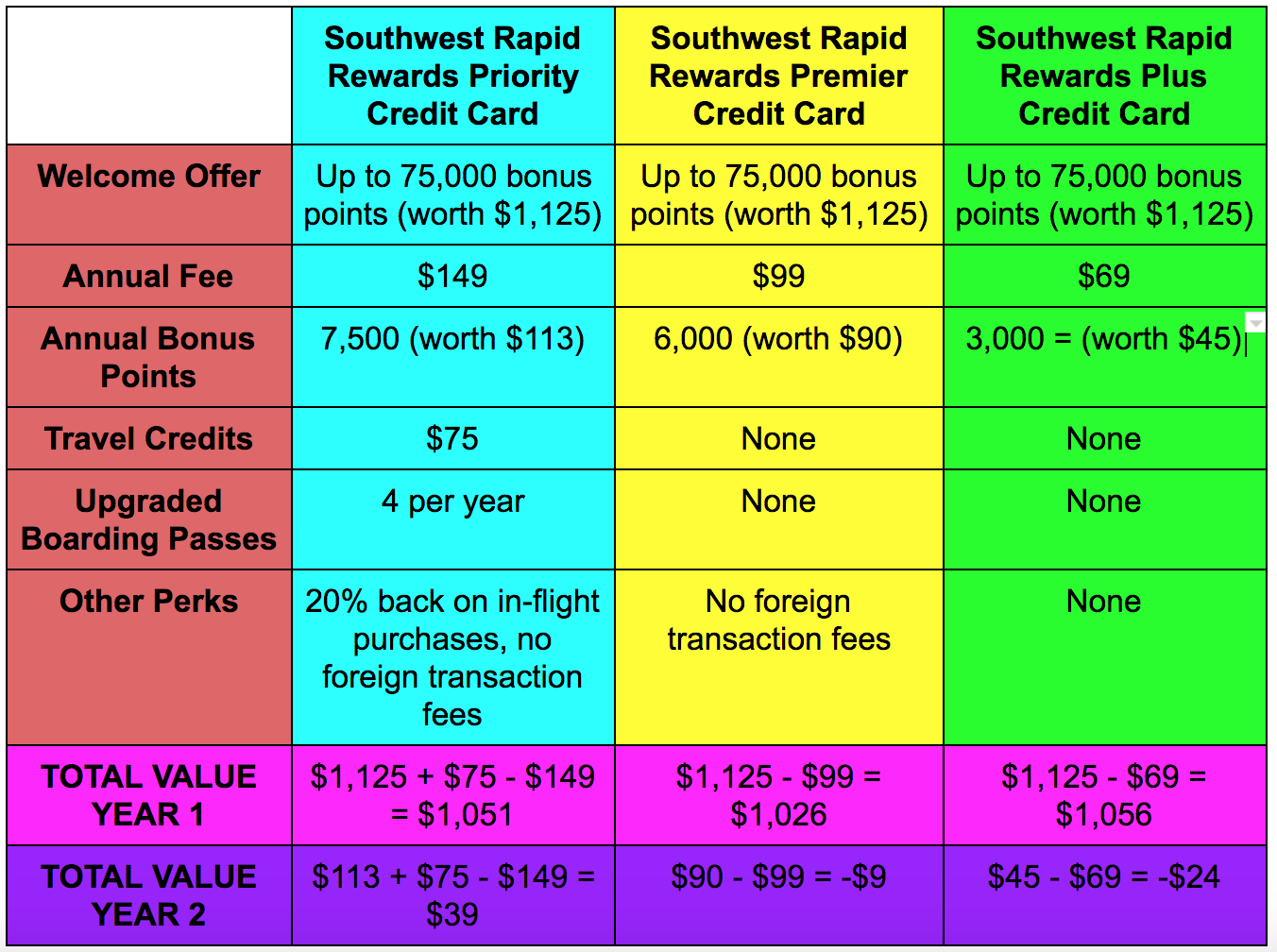

Comparing the Southwest Credit Cards

Although you’ll earn the same number of points on every single purchase, the main difference is the annual fee, the bonus points upon account renewal, travel credits and upgraded boarding certificates. Spoiler alert: The card with the highest annual fee will actually save you the most amount of money.

If you are looking at just year 1 of being a cardmember, you’ll see that the Southwest Rapid Rewards® Plus Credit Card will give the best value during the year. This is taking into the bonus points that you receive from the welcome offer (valued at about $1,125) and then subtracting the annual fee. Although, you are only $5 ahead of the value you’d receive with the Southwest Rapid Rewards® Priority Credit Card.

If you look past year 1, you’ll see that the Southwest Rapid Rewards® Priority Credit Card is actually the best value card. While this card has the highest annual fee, the $75 travel credit and the 7,500 annual bonus points more than make up for the annual fee. Actually, this is the only card where you can actually come out ahead. With both the Southwest Rapid Rewards® Premier Credit Card and  Southwest Rapid Rewards® Plus Credit Card you’ll be at a slight loss on a yearly basis.

Related: Southwest Companion Pass Secured — Free Flying for 2020 and 2021

Not only are you ahead with the Priority card (or just $5 years behind at year 1), you’ll also receive four upgraded boarding positions a year and 20% off in-flight purchases. I personally do not put a ton of value in these extra perks, but this is a really nice-to-have and worth a minimum of the $5 difference. The $75 credit can be used on a Southwest flight or taxes if you are using points, so I think of this as straight up cash. Also, if you end the year and realize you never used the credit, you can book a flight and then cancel it and receive $75 in Travel Funds to use for a future flight.

Overall…

If you are a Southwest flier or looking to earn the Southwest Companion Pass, these are three great cards to consider. I personally recommend the Southwest Rapid Rewards® Premier Credit Card as it will give you the biggest bang for your buck.

Keep in mind though that Southwest only allows you to have one personal card open at a given time, but you can have both a personal card and business card open if you want. This means you can also apply for either the Southwest Rapid Rewards Business Premier Credit Card or the Southwest Rapid Rewards Performance Business Credit Card and upon meeting the respective minimum spend to earn the maximum welcome offer, you’ll automatically earn the pass.

Related: 10 Tips When Using the Southwest Companion Pass

Disclosure: This post contains affiliate links. As always, thank you for supporting the blog and enjoy traveling on a deal.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Could you also do a chart for the Business Card

Could you also do a chart for the Business Cards as well

@Points for Four – Absolutely!