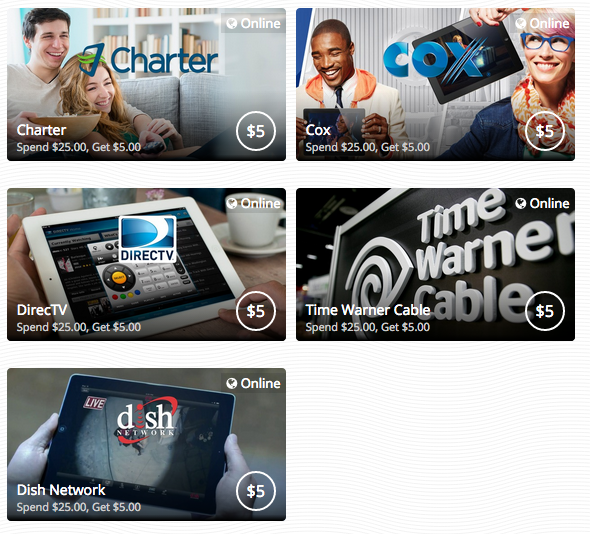

You can get $5 for free towards your cable phone bill if you have the Chime Card. It is extremely simple, if you have Comcast xfinity, Charter, Cox, DirecTV, Time Warner Cable, or Dish Network, you can go online, pay a one-time payment of $25 with your Chime card and get $5 back to your card. Ultimately resulting in $5 for free towards your cable bill which you’d have to pay anyways! This offer is valid through March 1, 2015 (or until it hits its maximum amount used). If you have no idea what the Chime Card is, read this prior post.

Unfortunately I have RCN so I cannot take advantage of this offer, but it worked seamlessly for me with the cell phone bill offer that I wrote about last week (and is actually set to expire tonight!). Remember, this is a one time statement credit per provider, so is not a huge money maker by any means by $5 is still $5 – it is really takes all of a minute. However, you can take advantage of the offer for all 6 of them, so if you have a friend or family member with another provider help them save money. Remember though, this is limited to the first 100 transactions per merchant.

Unfortunately I have RCN so I cannot take advantage of this offer, but it worked seamlessly for me with the cell phone bill offer that I wrote about last week (and is actually set to expire tonight!). Remember, this is a one time statement credit per provider, so is not a huge money maker by any means by $5 is still $5 – it is really takes all of a minute. However, you can take advantage of the offer for all 6 of them, so if you have a friend or family member with another provider help them save money. Remember though, this is limited to the first 100 transactions per merchant.

More about Chime… While you can find all details on the Chime card in this prior post, here is a synopsis:

- What is the Chime Card? A debit card where you must apply and enter your SS#. It is a soft inquiry, which will not affect your credit score.

- How do I apply? Apply here. You will receive a free $10 after you load your card with $50 or more. To get this you must sign up through a referral link. This is my personal referral link, but feel free to leave your own in the comments section. If approved you will not be able to take advantage of any of the offers until your card comes in the mail. In the meantime, however, you can setup your account online, download the Chime app, and fund your card.

- How do I unload my money from the card? Use your card at any merchant that accepts Visa! You can also purchase gift cards, i.e., Amazon.com, if you want to get the money off fast to use for future purchases. You can withdraw your money at an ATM (up to $500/day) but there is a $2.50 fee per transaction on domestic ATMs. You might also incur a fee from the ATM provider directly.

- What are the fees for this card? If there is no activity on your card for 180 you will be charged $5. Activity can be as simple as a $1 purchase or a $1 transfer from PayPal, but there still needs to be some activity. A $5 fee can add up so make sure to remember this! This card comes with a 3% foreign transaction fee.

- How do I take advantage of the Chime offers? The main purpose of this card is to receive money back with participating offers, not to use at everyday merchants. When you see an offer, it will tell you how many are left. Surprisingly, not many people use Chime, so even if you see there are only 50 transactions left for that one offer, it could take weeks to meet. Before you shop though, make sure there are at least a few transactions left to ensure you will get the money back to your Chime account. Each offer is only available once per card. One thing to note – purchasing gift cards typically works to trigger the cash back. If online, just make sure you are purchasing through the store directly and not a third-party merchant (which is typically with eGift cards but not physical plastic gift cards).

Other available offers… You can currently save money at these merchants when using your Chime card:

- Urban Outfitters – Spend $30, get $3 back

- Best Buy – Spend $50, get $5 back

- Wendy’s – Spend $10, get $2 back

- Ann Taylor – Spend $35, get $5 back

- Carrabba’s – Spend $30, get $3 back

- Dick’s Sporting Goods – Spend $30, get $3 back

- Jack Wills – Spend $30, get $5 back

- Marine Layer – Spend $50, get $5 back (online only and expires January 31)

And there are also the “New Years Resolution” offers where you can select the category to save money. I personally selected the “Travel” category where I can save money at Southwest Airlines, Virgin America, airbnb, and Flight 100. Related blog post.

Overall… I found the process of applying and using the card incredibly easy. Most recently I’ve taking advantage of purchasing a Southwest $50 gift card and getting $5 back, Amazon.com offers where if you make a $5 purchase you get $5 back, and a few other merchants! The good thing is that the cash back hits your account typically within a few minutes of making the transaction! While this isn’t going to make you a ton of money, it could save you some money over the course of the year. I assume I’ll save about $100, which is great for putting in hardly any effort.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

They require a mobile phone number. Presumably so they can send you irritating messages.

Hardly worth it for $100 a year and a whole of work keeping track of everything.

@Bob – I do not receive any messages from Chime, you can set it up based on your preferences.

Hi,

Why didn’t I see Comcast xfinity cable bill qualified for this offer?