Just yesterday, Chase changed the publicly available sign up offer for their co-branded card card. Instead of giving new members a flat number of bonus points after meeting a minimum spend threshold, they decided to change it up a bit—instead you’d earn 4x points on all purchases for the first year as a cardmember, up to 120,000 points. While this might sound like a great offer on the surface, there is actually a better offer for the exact same card that is even better. It will allow you to earn the same number of points, but with less spend required.

The Better Offer!

With this other offer (let’s call it offer B), you’ll also be able to earn up to 120,000 points, but there are tier minimum spend requirements to meet to earn the points:

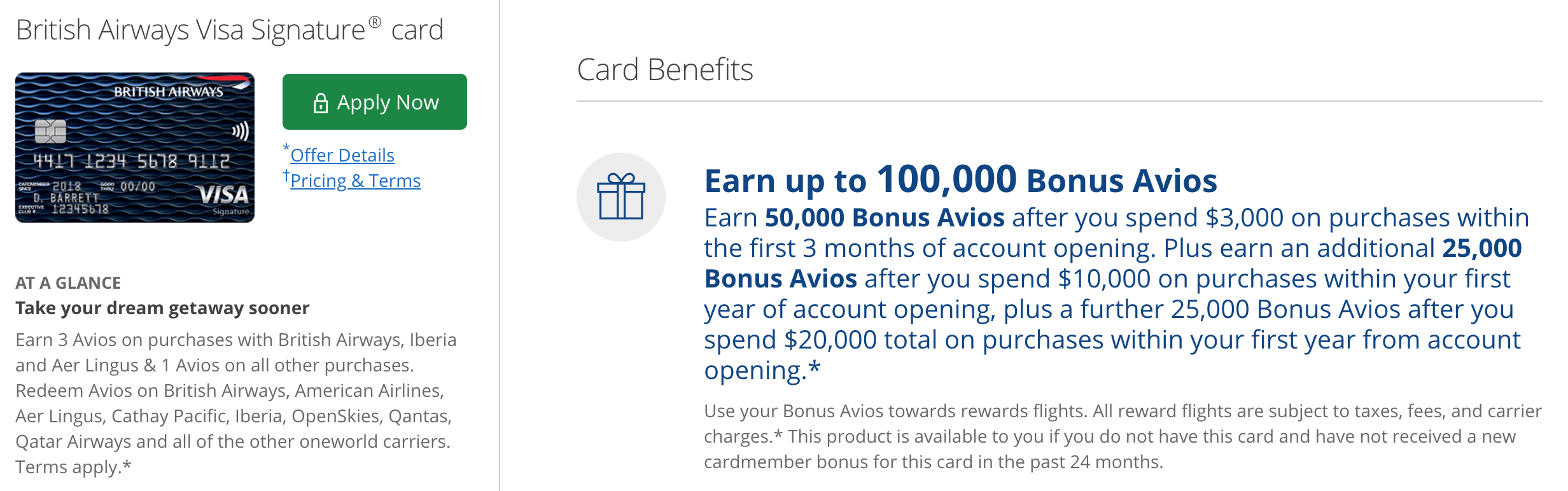

- Earn 50,000 Bonus Avios after you spend $3,000 on purchases within the first 3 months

- Earn an additional 25,000 Bonus Avios after you spend $10,000 on purchases with your first year of account opening

- Earn a further 25,000 Bonus Avios after you spend $20,000 total on purchases within your first year from account opening

On the surface this only looks like a 100,000 point offer, but once you add in the points earned from the purchases meeting the minimum spend, that will get you an extra 20,000 points for your $20,000 spend—for a total of 120,000 points!

This means you can earn the exact same 120,000 bonus points but only after $20,000 spend, not $30,000 spend like the new offer that surfaced yesterday (let’s call it offer A). Now, if you are not able to put $20,000 on the card, this offer is still better. Let’s take a deeper look.

- At only $3,000 spend, Offer B will earn you 53,000 bonus points (50,000 bonus + 3,000 from minimum spend), while Offer A will only earn you 12,000 bonus points (3,000 from the spend multiplied by 4x points)

- At only $10,000 spend, Offer B will earn you 85,000 bonus points (75,000 bonus + 10,000 from minimum spend), while Offer A will only earn you 40,000 bonus points (10,000 from the spend multiplied by 4x points)

There is actually no amount of spend where you will actually come out better by applying for Offer A. So if you see this offer written about on other blogs (i.e., the affiliate link offer) DO NOT APPLY!). There is actually a better offer available which you can apply for here.

NOTE: This is not an affiliate link, which means I do not make any commission if you apply and get approved for this card. But, this is by car the best British Airways credit card offer available and I only write about the best offers for my readers!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You should probably be responsible and note that BA cards are now subject to 5/24.