Plastiq has been one of my favorite ways to earn points and miles over the past few years as it has allowed me to use a credit card to pay bills where the merchant wouldn’t have taken credit cards directly. For me personally, I’ve been able to pay my son’s preschool tuition, my daughters after school program, my mortgage, and even my taxes. This adds up to be a large chunk of change so earning points, miles, and even cash back on these purchases is pretty big.

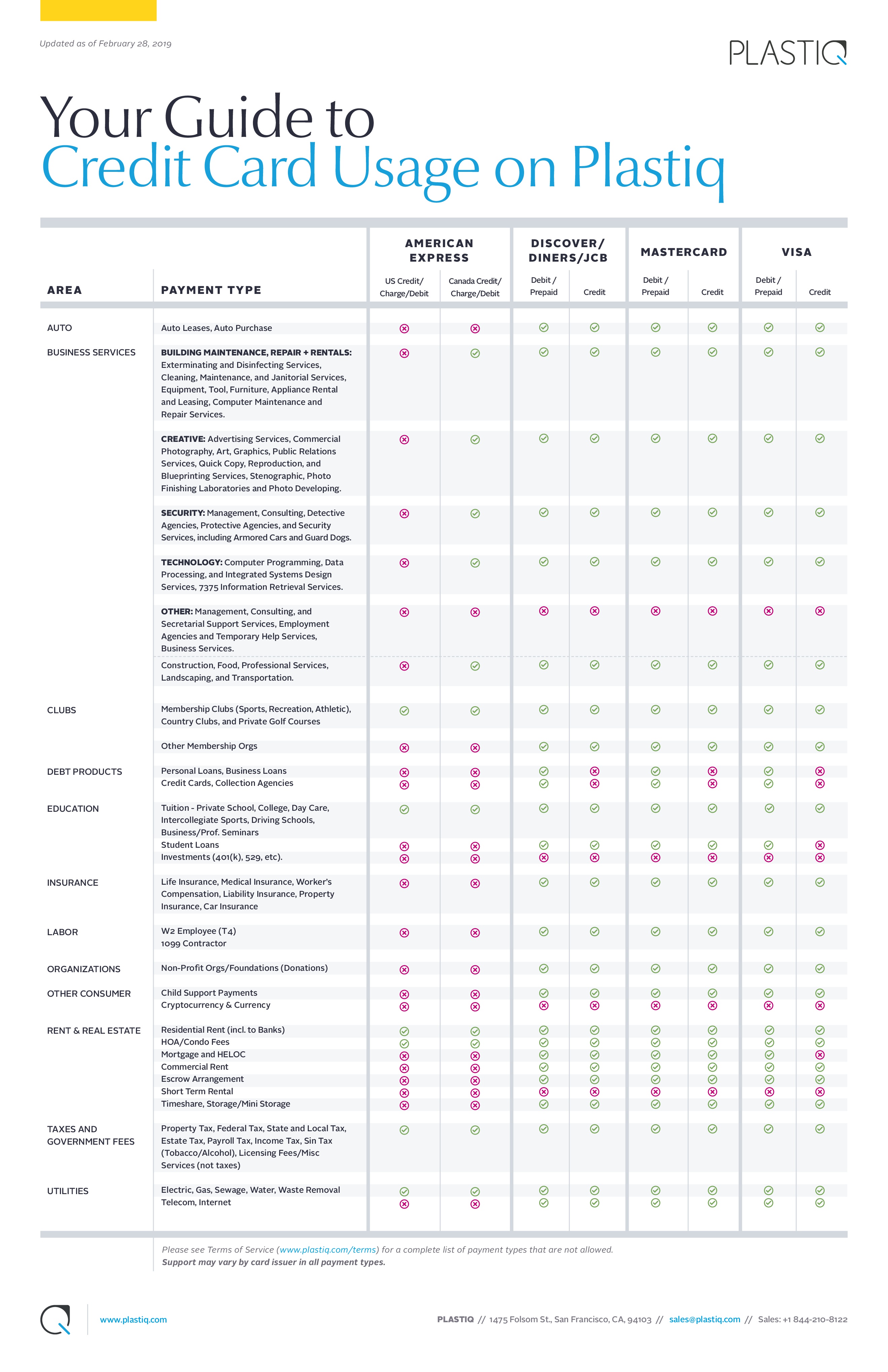

The only problem though is that you cannot use all credit card types for all payment categories. Up until this point it has been kind of confusing on which credit cards Plastiq will and will not support, but fortunately, Plastiq just sent me a pretty handy dandy matrix which is easy to follow.

As you can see from the chart above, American Express credit cards are the most limited, followed by Visa credit cards—although there are still many payments you can put through on these cards. For many, not being able to pay your mortgage through either is huge, but you can still pay it with a Discover or Mastercard. And fortunately, you can use any card type for your taxes!

Keep in mind that using Plastiq is by no means free! Typically, they charge a 2.85% fee, so you’ll want to make sure you are using a card where you’ll earn more than the fee incurred. Or, if you are trying to hit minimum spend for a welcome offer, it might be worth the fee.

Here are some cards that might be worth it:

- Discover It Miles: Earn 1.5% cash back, however, all miles earned in the first year are doubled which means all Plastiq purchases in the first year will net you a 3% return. This means you are coming ahead with a 0.15% return.

- Chase Freedom Unlimited: Earns 1.5x on all non-category purchases, but if you have the Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Preferred, you can transfer your points to one of those “Premier†cards and then transfer your points to partner loyalty programs. I personally value those points at about 2 cents per point, so your Plastiq purchase will net you about a 3% return. Again, this means you are coming out with a 0.15% return but to use for travel purposes.

Promotions for Free Payments

Right now, Plastiq is offering a few different ways to earn “Fee Free Dollars”. When you earn FFD’s, you can apply them to your payment and ultimately the fee you pay to Plastiq is waived. This is a great way to truly earn points, miles, cash back for free!

- New Personal Users: If you are a new user to Plastiq, if you sign up through a referral link (thanks in advance), you’ll earn $500 “fee-free dollars” after your first $500 spent. You can think of this as only paying a 1.425% fee on your first $1,000 spent. For most points and miles credit cards, you’ll absolutely come ahead and it could be a great way to get some minimum spend under your belt or $1,000 towards earning a particular credit card benefit.

Overall…

Plastiq can be a great opportunity to earn points and miles. I personally used it a ton last year on my Southwest Credit Card to earn the Southwest Companion Pass. I am now using it this year to put a decent amount of spend on my World of Hyatt Credit Card as I am going for Globalist status. Ultimately, this has been a very easy way to earn some great benefits in the travel world while also receiving some extra points and miles along the way.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Good article! It would be great if you could elaborate further on the mechanics using examples such as when I use it for my son’s preschool tuition or my mortgage (recurring monthly fee) I complete the transaction x days before it is due and the check always arrive on time? Can you set up a recurring function? Or for non-recurring fees (such as taxes), if I complete my paperwork with Plastique x days ahead, it isn’t a problem. Maybe also detail if you have had problems using Plastique and how you overcame them?

Hi, are most of your transactions coded in Plastiq as “Business Services” when using a Visa card to pay?

Thanks

This chart seems inaccurate since Prepaid Visas dont seem to successfully process for any payment type I make.