I am on year 11 for the Southwest Companion Pass and I have to keep the streak going. The pass has saved my family thousands of dollars on travel and Southwest is truly our families airline of choice. Being able to change and cancel our flights for no fee as well as getting flights re-priced if they decrease in the number of points required are huge perks for us.

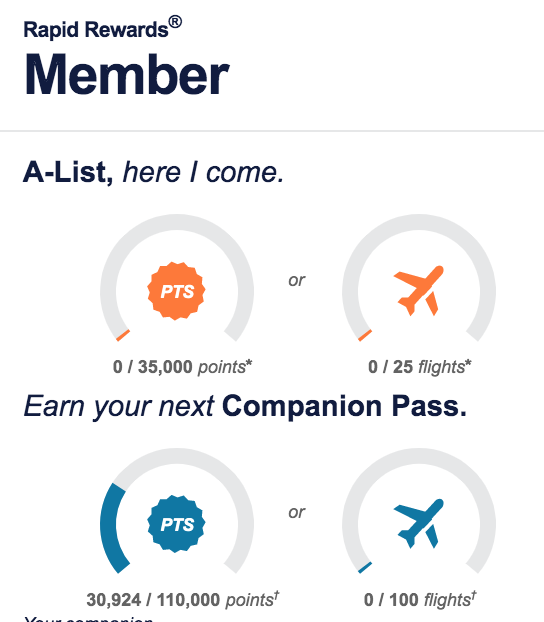

As 2019 is winding down, I realized I am running pretty low on maintaining the Companion Pass for 2020. I am only at 30,000 points out of the 110,000 points required. The chances of earning the 80,000 point difference within a three months timeframe is pretty low, so I had to figure out a new Southwest Companion Pass strategy. Note: Points reset on Jan. 1st of every year.

UPDATE: Southwest in now requiring you to earn 125,000 points starting Jan. 1, 2020.

I decided that instead of earning it just for 2020, I am better off earning it for both 2020 and 2021. When you earn the companion pass, the pass is valid for the remaining year it is earned plus the entire following next year. If I earn the pass in 2019, that means it will expire on Dec. 31, 2020. (Since I already have the pass for 2019, earning it now only extends it for 12 months). Now, if I can earn the points in January of 2020, then I’ll have the pass for the rest of 2020 and then all of 2021. The pass will then expire Dec. 31, 2021. That is almost 23+ months of flying BOGO.

My Southwest Companion Pass Strategy

Right now, my best bet is to apply for the Southwest credit cards. They are currently offering increased limited time offers with the Southwest Rapid Rewards Performance Business Credit Card. (When I applied the offer was 80,000 points). Due to this offer I went ahead and applied for the card and was fortunately approved. NOTE: I was grilled with many questions about my business, so just be prepared.

Since I have three months to meet the minimum spend, that will bring me to the beginning of January for spending the $5,000 required. (Make sure to be strategic for when you apply for the pass and meet the minimum spend requirement). The bonus points do not hit your Southwest account until a few days AFTER your monthly statement closes where you meet the minimum spend. So as long as I wait until Jan. 1st to spend that last dollar, the points will post in January. I will then be 30,000 qualifying points shy to earning the Companion Pass (based on the offer when I applied). Since I have a flight already booked in February, I will need to earn those points quickly. This will easily be done by using my Southwest credit cards for large purchases and using their online shopping portal.

With my strategy, I will earn all 110,000 points required in mid-January (or a few days after my January statement closes). Not only will those points automatically put me over the threshold of earning the points, they can also be used to redeem on Southwest flights. Those 110,000 points are worth approximately $1,650 on Southwest. And as long as a Companion flies with me on every flight I take in 2020 and 2021 while using those points, they are actually worth $3,300 since my companion will fly for free.

Credit Card Method to Earning the Pass

If you do not have many other ways to earn the Companion Pass, the Southwest Credit Cards might be your best option. Some of you might even be able to apply for two different credit cards to secure the pass right away. I personally already have two other Southwest personal credit cards so I am not eligible to apply for another one of their personal cards to secure the remaining points required.

Southwest Personal Card plus Southwest Business Card

While Southwest does not allow you to have two personal cards open at the same time, you are allowed to open up both a personal card and a business card. For example, you can apply for the Southwest Rapid Rewards® Priority Credit Card plus the Southwest Rapid Rewards Performance Business Credit Card— putting you well over the threshold required and allow you to earn the pass with no extra work.

The above are just two examples of card combinations, but really any personal card plus business card will work. Many readers have also had success with getting both business cards approved.

With that being said, Chase is definitely cracking down on approving people for a business credit card. To increase the chances of being approved, make sure to use your EIN (and not simply just your Social Security Number) when you fill out your application. I was asked many many many questions about my business, but at the end of the call was eventually approved.

Southwest Personal Card or Southwest Business Card

Now, if you only want to apply for one card, you will still get at least half of the points required. If you are going to go this route and are eligible for a business card, apply for the Southwest Rapid Rewards Performance Business Credit Card as it is offering the highest welcome offer and will also not count against your Chase “5/24” status.

Now, if you are not eligible for a business card, all three Southwest personal cards will still get you half way there. They are also much easier to get approved for than business cards.

Tip: Make sure your minimum spend does not hit until January 2020, so the points will count towards your 2020/2021 companion pass.

Overall…

I am definitely excited to continue my streak with the Southwest Companion Pass for the next two years. The Companion Pass has already taken my family to Ft. Lauderdale, Orlando, Tampa, Ft. Myers, Cancun, Aruba, Punta Cana, Los Angeles, San Francisco, Detroit, Phoenix, Denver, Salt Lake City and Washington DC (and I am sure many others that I am forgetting).

In just the first half of 2020 we already have numerous trips planned where the pass is already saving us $1,000+. This includes a beach vacation in Ft. Myers, skiing in Park City and visiting Mickey Mouse in Disneyland. And of course many other destinations will be added as well making our savings even greater.

What is your Southwest Companion Pass strategy?

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Congrats – I hate to nitpick but the companion pass does not make the points worth double. In fact, the companion pass could be worth much more than $1,650, it depends on how many times you use it in a year, and what those fares would have been. It has nothing to do with a credit card bonus $ amount. Some years I got $1,000 of value and some years I easily got well over $2,000 of value. Also it can work on paid trips (like you I don’t have many of those), so that can add to the value as well, regardless of if points are used. It’s hard for me to get the companion pass any more at 11/24, but at least I’m making more on the bonuses than I’m losing by not having the CP any more, but I miss it!

@John – Depending on how much you fly, the value could be quite high!

You mentioned that you were grilled when applying for the Southwest Performance Business card and that we should be prepared. I don’t have a SW Business card and am going to apply. My business will be ” conducting estate sales” and am just starting with no track record yet. What questions will be asked and how do I make sure I am prepared? Thanks for any advise.