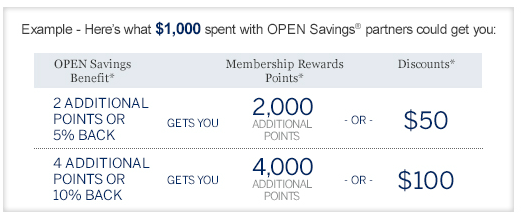

One of the great perks of the Amex Business cards is that you have access to the OPEN Savings Benefits where you get discounts at certain merchants just by paying with this credit card. After looking into this benefit again, I realized that the program has changed slightly in the past few months. It used to be you got a straight discount (the percentage differed per merchant), but now you have the option of selecting a discount vs. bonus points. Overall, you have the option of getting 4 additional Membership Rewards points OR up to a 10% discount on eligible purchases with OPEN Savings partners.

- Hertz: Up to a 10% discount OR up to 4 additional Membership Rewards® points

- $0-$500 spend per year: No discount or additional Membership Rewards® points

- $501-$2,500 spend per year: 5% discount OR 2 additional Membership Rewards® points

- $2,501+ spend per year: 10% discount OR 4 additional Membership Rewards® points

- Applicable only at Hertz corporate-owned U.S. locations, excluding Puerto Rico and the U.S. Virgin Islands locations; Excludes Hertz on Demand

- Carey: 5% discount OR 2 additional Membership Rewards® points

- Excludes any reservations made through franchises or third party

- FedEx Express, Ground, Freight: 5% discount OR 2 additional Membership Rewards® points

- This is up to $20,000 spend per year (Express and Ground is combined, while Freight is a separate maximum)

- FedEx Office: Up to a 10% discount OR up to 4 additional Membership Rewards® points

- $0-$250 spend per year: 3% discount OR 1 additional Membership Rewards® points

- $251-$1,000 spend per year: 5% discount OR 2 additional Membership Rewards® points

- $1,001-$100,000 spend per year: 10% discount OR 4 additional Membership Rewards® points

- HPDirect.com: Up to a 10% discount OR up to 4 additional Membership Rewards® points

- $0-$200 spend per year: No discount or additional Membership Rewards® points

- $201-$1,000 spend per year: 5% discount OR 2 additional Membership Rewards® points

- $1,001-$50,00 spend per year: 10% discount OR 4 additional Membership Rewards® points

- Applicable only for purchases made online at www.HPDirect.com or by calling 1-866-511-0279; Excludes purchases made in retail stores or any other online website and on purchases of gift cards

- EpsonStore.com: 5% discount OR 2 additional Membership Rewards® points

- Applicably only for purchases made at Epsonstore.com and telephone purchases made by calling 1-800-873-7766

- Microsoft Store: 5% discount OR 2 additional Membership Rewards® points

- Applicable only on purchases made at microsoftstore.com and at Microsoft retail stores located in the United States; Excludes purchases of Office 365, mobile phones, phone accessories and service plans, Surface and Microsoft Surface accessories, and purchases made at the Microsoft Company Store in Redmond, Washington

- This benefit will end May 15, 2013

- OfficeMax.com: Up to a 10% discount OR up to 4 additional Membership Rewards® points

- $0-$250 spend per year: 5% discount OR 2 additional Membership Rewards® points

- $251+: 10% discount OR 4 additional Membership Rewards® points

- Applicable only on purchases made at officemax.com, and purchases made by telephone order and by registered users at officemaxworkplace.com; Excludes purchases made at retail locations

- Dun & Bradstreet: Get a 5% discount OR 2 additional Membership Rewards® points

- This benefit will end May 15, 2013

- 1-800-FLOWERS.com: Get a 5% discount OR 2 additional Membership Rewards® points

- Barnes & Nobles: Get a 5% discount OR 2 additional Membership Rewards® points

- Applicable only on online purchases made at BN.com; Excludes purchases made in Barnes & Nobles stores

This discount vs. point option is only available for those that have a Business Card from American Express OPEN and enrolled in the Membership Rewards program. If you card is NOT eligible to receive points, you’ll only be able to receive the discount, not the point option.

To change your savings option, you will need to Choose Your Benefit at this American Express site here. You can only select Discounts or Membership Reward points as an overall option, you cannot select per individual merchant. Changes typically take effect within 48 hours but can take up to two weeks. You can change your benefit setting once per calendar month.

So which option should you select – Discount vs. Points? Overall, this is going to depend on how you personally value your Membership Reward points.

- If you only use your Membership Reward points with the “Pay with Points” option (thus getting 1 point per $), then you absolutely will want to select the discount option.

- If you typically transfer your Membership Reward points to partner loyalty programs and get 2.5 cents per dollar, you’ll even out, so I’d suggest opting for the discount as cash is king! If you get less then 2.5 cents per point, then go for the discount option as well.

- If you are able to get more than 2.5 cents per point for your Membership Reward points, then select the points option.

Remember, you’ll still get your normal points by just using the card.

Disclosure: This post contains affiliate links. Thanks for supporting the blog and enjoy traveling on a deal!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Does the SPG business card give you the option for extra membership rewards card as well? or it gets discount only?

Note that the Marriott brands are going away July 1, and Dun & Bradstreet and Microsoft on May 16: http://boardingarea.com/rapidtravelchai/2013/04/21/amex-open-savings%c2%ae-dropping-marriott-dun-microsoft/

@Rapid Travel Chai – Yup that is correct, unfortunately! I listed it for each partner.

You can always buy more points at 2.5 cents each (up to 500,000 if you have a business platinum card, for example). So one should always take the cash. If you value points less than 2.5 cents, then you come out ahead taking cash. If you value points more than 2.5 cents, take the cash up front and buy points when you need them.

You should correct your bonus for your Starwoods card so that it says a 25K bonus instead of 5K. 😉

[…] points at 2.5 cents each. The only difference is that some merchants offer a more generous reward. Deals We Like suggested earlier this week that your choice of points or cash back should depend on how you value Membership Rewards points. […]

[…] points at 2.5 cents each. The only difference is that some merchants offer a more generous reward. Deals We Like suggested earlier this week that your choice of points or cash … Share from Hack.Travel:FacebookGoogle […]