I am probably not alone when I say that Amazon is one of my favorite online shopping stores! Who is with me here? I am asked quite often “What is your recommended credit card to use at Amazon to earn the most points, miles, or cash back?” There is actually a good chance that some of them might surprise you and even be new to you! So here is a list of credit cards for Amazon purchases.

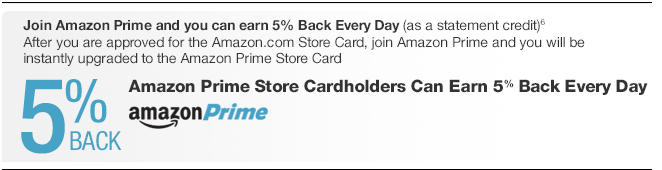

- Amazon Prime Store Card: This card offers 5% cash back on all Amazon.com purchases! There is no limit to the amount of cash back you can earn! If you are looking for straight money in your pocket for your Amazon purchases this is the card for you! The big downside of this card is that it can only be used for Amazon purchases, no where else. There is no annual fee for this card, but you must be an Amazon Prime member. Also, this is a retail card which charges extremely high APR, so make sure to pay off your bill in full each month.

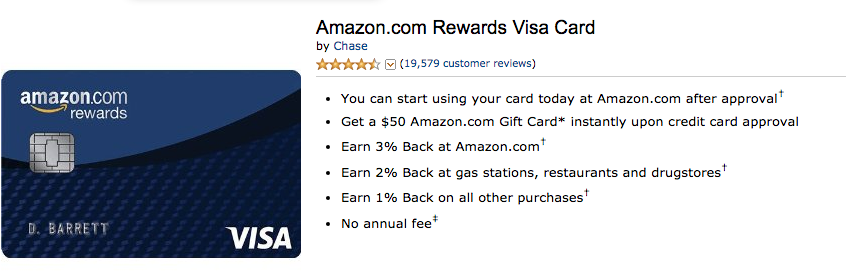

- Amazon.com Rewards Visa Card:Â This card only offers 3% cash back at Amazon, so significantly less then the Store Card. If you are looking to maximize your Amazon purchases, this is actually not the most ideal card for you!Â

While this is a Chase card, it does not fall under the Chase “5/24” rule.

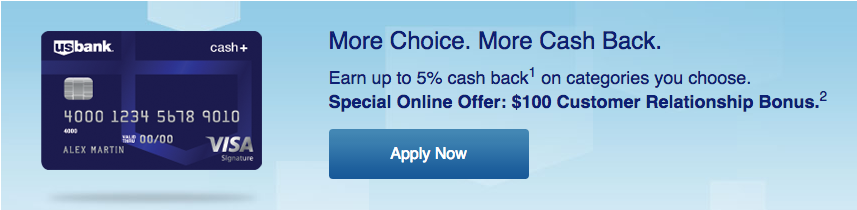

- U.S. Bank Cash+ Visa Signature Card: This card offers 5% cash back on two categories a quarter. This card offers the same categories every quarter (they are not rotating categories like some similar cards). You can earn up the 5% cash back up to $2,000 spend per category, thus giving you up to $100 cash back. Bookstores is one of the participating categories that you can select month and month. Amazon (aside from Marketplace purchases) codes as “bookstore”. To ensure all purchases code correctly, you can always purchase Amazon gift cards and then store the gift cards in your Amazon account to use for all purchases). This card also has no annual fee.

- Discover it Cashback Match: For Q4 2016, Discover is offering 5% cash back on Amazom.com purchases. This is one of their rotating categories for the quarter. You’ll earn the 5% cash back on the first $1,500 spent in the combined categories. Discover has not yet announced their rotating categories for Q2, Q3, and Q4 for 2017, but my assumption is we will see Amazon on at least one if not two quarters. This year they were part of Q3 and Q4. Additionally, one of the perks of this card is that they will give you a 100% match on all points earning during the first year having the card. So for the first year during any quarter where Amazon is listed, you’ll actually receive 10% cash back! This is actually the highest offer out of any other card! This can ultimately give you $150 cash back during the quarter. This card also has no annual fee.

- Chase Ink Plus/Bold/Cash: While these cards do not earn any special bonus at Amazon directly, they do earn 5x points at office supply stores. At Staples, for example, you can purchase Amazon gift cards and receive the 5x points. You can then use those gift cards directly at Amazon. If you value your Chase Ultimate Reward points at 2 cents per point (the valuation all depends on which cards you have within the Ultimate Rewards family), then this can be a 10% discount! Keep in mind though that the Ink Plus and Ink Bold are no longer available.

- American Express Membership Reward cards: Amex Offers recently came out with a targeted offer where American Express Membership Reward earning cards can receive 3x points on all Amazon.com purchases through December 31, 2016. This is a limited time offer, but definitely a great way to maximize the points you earn through the end of the year. You can read more about this Amex Offer and how to register here.

Overall…

The two Blue Cash American Express credit cards are by far the better options, but remember, they are only for new card applicants and the bonus offer only lasts the first 6 months. You are also capped at the bonus up to $200 in statement credits. The Amazon Prime Store card and one of the Chase Ultimate Reward earning cards are ideal cards to maximize your savings at Amazon on an ongoing basis. The only thing is the Chase Ultimate Reward cards require an extra step of going to the store first to purchase the gift card and you need to make sure you do not lose the gift cards. The Amazon Prime Store cards is the easiest way to go and is still available for new applicants, unlike the Chase Ink Plus and Chase Ink Bold. With this card, you get a consistent 5% cash back with no cap. If you are a big Amazon shopper, this is definitely a card to look into!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Citi Forward card unfortunately changed their terms back in June….no more 5x on bookstores 🙁

@Matt E – Thanks for letting me know. Bummer!

Can you explain how this happens?

“If you value your Chase Ultimate Reward points at 2 cents per point,…. then this can be a 10% discount! ”

I buy Amazon cards at office stores with the Ink card, (5 UR pts / $1) then what ?….

@Rachel – Since you earn 5x points per dollar spent, and I value Chase UR points at 2 cents per point, this is ultimately giving you 10% back (to use towards travel) on your Amazon purchase. If you go to Staples, for example, you can purchase a $100 Amazon gift card (there are other denominations as well). The gift card purchase will yield you 500 Chase Ultimate Reward points. Those 500 points are then worth $10 in my valuation. So a $10 valuation on a $100 Amazon gift card is 10%.

Let me know if this helps!

Yep, Citi Forward is at 2x with Amazon now. 🙁

Also, some AMEX cards get 3x Membership Rewards points at Amazon till 12/31/16.

@Richard – I wrote the post before this offer came out, but just went ahead and included it. It is a limited time offer though, but still great for those that already have the card!

How about the AmEx Blue Cash Everyday? It claims to pay 10% cashback on Amazon for 6 months up to a maximum of $2,000 in purchases

@Rohan – Thanks so much for pointing out that it was completely left out. That was the first one on my list and somehow a totally oversight that it wasn’t in the post. It is now there!

While it won’t matter to many since its no longer available, anyone with a Sallie Mae card will get 5% (up to $750/statement cycle) on Amazon purchases. Just an FYI for anyone who has it but might not realize that “bookstore” applies to Amazon. Personally, I load amazon gift cards to ensure that it codes properly (sometimes third party sellers have issues). It actually turns into 5.5% cash back after funneling the cash back into Upromise and then a high yield SM savings account which yields a 10% yearly bonus.