UPDATE: This is no longer available.

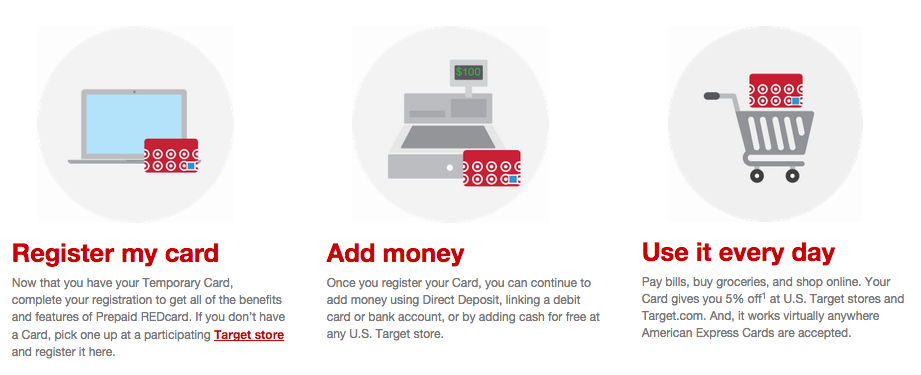

Loading your credit card at Target to your REDCard has been a very hot topic in the points and miles world. This is because you can load up to $5,000 per month ($2,500 per day and $1,000 per load) to your REDCard. And the best thing is that you can use your credit card to do this thus earning points and miles! You can then use your Target REDCard as a regular debit card, to shop at Target (and get a 5% discount), or most importantly pay bills! For paying bills, this means you can pay any bill or person – even your credit card bill that you used to load the card!

This is one of the best cards as the only fee is the initial cost to purchase the card which is $5. It is a one time fee and that is it! The main downside of this card is that purchasing the temporary card is not available everywhere. Only select stores cary it unfortunately (you can check here). Although, if you have a friend that lives near another store, they are able to purchase one for you by entering your Social Security number when purchasing the card (or a fake SS #) and you can change it when you register the card online. There is no hard pull like applying for a credit card when purchasing this card. Even if a store does not sell the card, you can still load the card at that store. Some stores, however, you can only load the card at customer service and not a check out register.

I promise I will dedicate an entire post to an overview of the Target REDCard later this week.

So now the question, and the real purpose of this blog post is, “What credit card to use to loading your Target REDCard?” For the purpose of this post, I’ll assume the max load of $5,000 a month. Remember, you can pay your rent, mortgage, credit card bills, a friend, car payments, etc.

So which card is best?

This really depends on the person and what they are looking for. Are you trying to meet minimum spend? Do you fly one airline or stay at one hotel over another? Do you prefer the flexibility of using a fixed redemption program, etc.I personally find the load process at Target to sometimes be quite annoying. Typically it gets flagged as fraud so a phone call to the bank is required. However, I find American Express to be much better to deal with than Chase. With American Express you can immediately accept the charges on the American Express app and no call to the bank is required. This is one reason I use an American Express card (specifically my Starwood American Express) over Chase. There are times you might need to use a card to meet minimum spend requirements.

You then need to consider if you are more interested in maximize your miles or the perks of spending $X in a year. For example, using your Southwest credit card clearly will not get you the most value, however, if you are looking to earn that companion pass, this additional spend could be a great way to get there and outweigh the points earned on a different card where you might get a better value. Another example is getting a free Hilton weekend night just by spending $10,000 on your Hilton Reserve card. While Hilton has really devalued their points recently and I’d prefer earning a third of the points in the Chase Ultimate Rewards program, a free night certificate could be well worth it. If you are slightly shy of your desired airline status, you can spend the required amount to earn those miles towards status.

If the perks are not part of your decision making factor and you are interested in earning airline miles, hotel points, or points in a flexible program where you can redeem at hotels/airlines, I’d personally suggest using the Starwood American Express, Chase Sapphire Preferred, or British Airways. As I mentioned above, I personally use my Starwood American Express for a few reasons: 1) It is an Amex so much easy to avoid calling the fraud department after every purchase (at least based on my experience), 2) The points are deposited to your Starwood account on a monthly basis so if the bank looks into these purchases and for whatever reason decides to close your account your points are not with the bank directly (i.e., Chase Ultimate Rewards), 3) Starwood points are awesome! 4) Starwood has an extremely flexible program where you can transfer to many airlines at a 1:1 ratio and get a 5,000 point bonus for every 20,000 points transferred (i.e., American and Delta, NOT United though!).

The chart above can also be used in any application, not just loading their Target REDCard, but for anyone who has high credit card spend for whatever reason and wondering what card to use. Although keep in mind that they do not take into consideration bonus spend, for example, many cards give double points at hotels, travel, dining, etc.

If you want to learn more about this specifics of many of the cards listed above, along with the sign up bonus and other perks, take a look at the Promotions and Credit Card page. Let me know if you have any questions!

Which card do you use to load your Target REDCard?

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

The math on the Barclaycard Arrival card seems off. I’m assuming you’re referring to the Arrival Plus which gets 2x points on all purchases. So $5000 X 2 = 10,000 X 12 = 120,000 * .1 = $1,200.

IHG MC gets you 10,000 points a month, too.

I earn 2x using flexperks.

If you have Freedom + Sapphire/Ink, that will count as 5500 points instead of 5350 from Sapphire.

Do you know if/when you can reload your RedCard from overseas? I having been using mine for the past 4 moths however I am going to be moving to Australia at the end of the month. Do you think the Target’s in Australia will be able to reload my Red Card?

@Lauren – I really have no idea about Target overseas.

IHG MC earns 2x with REDbird: 10k a month.

There are no Target stores in florida that offer the prepaid Redcard. My husband often travels to MA, where according to Target’s website, several locations offer the prepaid RedCard. However, he already has a Serve account that he does not want to cancel. I have a Bluebird account that I was planning to cancel anyway (was going to switch to Serve, but I like the Redbird idea even better). Can he buy a card for me when he is in MA, and let me register it online later?

I read from target website that the REDcard has a debit card and a credit card. How are they different? Your article is talking about the debit card or credit card? Thanks.

dishonest post! Read all the shut down reports due to the Target loads alone in last couple of months! Card companies like Chase, Citi and specially US bank has been shutting down accounts and banning from ever getting their cards again for the reload abuses! They specially hate Target abuses cos they say tall due to the recent massive data breach where the card companies lost millions!

Please delete your post! or at least WARN your readers about reload abuses!

@jim – with anything you always want to tread with caution. However, I haven’t read reports of people’s accounts getting shut for simply loading their card.

Jim, if you want to be helpful, then at least be specific and please provide evidence. Don’t say “it’s on FT! go look!” either. Come on.

I have been procrastinating on switching my bluebird to this card. I believe the credit card load capability is a mistake and soon to be rectified. In looking at the redbird page no where does it say it can be loaded with a CC. I just know with my luck as soon as i get it they will cancel the CC load ability

I guess I will be the bearer of bad news. When I approach the Target store this evening, the manager seeing me with the card told me right away that they have suspended the use of this card indefinitely. He kept on repeating “and this card isn’t from here.” Even when I pushed and say, “so you are an independent Target?” I was told that, sorry they just cannot process the RedCard at this time. He wasn’t able to give me a deadline as well.

@Kai – This is the first I’ve heard of this. Do you mean purchasing the card, using the card, or loading the card?

Phatmiles,

Can you please explain? Thank you.

I took advantage of the TCB 2.25% off AMEX GCs. I have been using my SPG AMEX Biz and Personal cards to load but figured this would be a way to diversify. I also put plenty of normal spend on them.

@medichill – That is great!