On May 23, 2016 I wrote that the highly anticipated Chase “5/24” rule was not yet in effect. That was based on personal experience applying for the Chase Marriott Business credit card 2 days prior (on May 21, 2016). With that card, I was approved with no problem and was happy to see that Chase was still allowing people to be approved for cards even if they’ve applied for more than 5 cards within the past 24 months.

Recap of the Chase “5/24” rule: Last year Chase put in place a “rule” where you could only be approved for one of their personal branded credit cards IF you had less than 5 credit cards approvals in the past 24 months. This became known as the “5/24” rule, but did NOT apply to Chase business cards or co-branded cards (i.e., Ink Business, Marriott, Hyatt, IHG, etc.). This past March, there were many reports stating that this “5/24” rule would go into affect for both Chase business cards and Chase co-branded credit cards (the reports stated that Chase business cards would be affected March 2016 and Chase co-branded cards would be affected April 2016).

Well a day or two after I wrote that post, there were some reports that the rule had actually gone into effect. You can read these reports on these blogs: Doctor of Credit, Frequent Miler, One Mile at a Time. They stated that people who applied on May 22, 2016 were being denied due to the unofficial “5/24” rule. This is not a rule Chase representatives coined and instead they will simply tell you that you are being denied due to too many credit cards opened in the past two years. This is not just the number of Chase credit cards opened, BUT all credit cards that you have opened including being added as an authorized user.

These reports also stated that this seemed to be the case for almost all Chase business cards and co-branded cards, except the following:

- Chase IHG

- Chase Hyatt

- Chase British Airways

- Chase Disney

- Chase Fairmont

- Chase Amazon

- Chase AARP

I took it upon myself to apply for one of the above cards myself and see what happened. The only card I am semi interested in AND eligible for is the Chase British Airways cards. I currently have the IHG and Hyatt credit card and currently am not interested in applying for the others. While I’ve had the British Airways card in the past, I received the sign up bonus probably 3-4 years ago and cancelled the card a year after. Since I do not currently have the card and have not received the sign up bonus in the past 24 months, I am eligible for this card again.

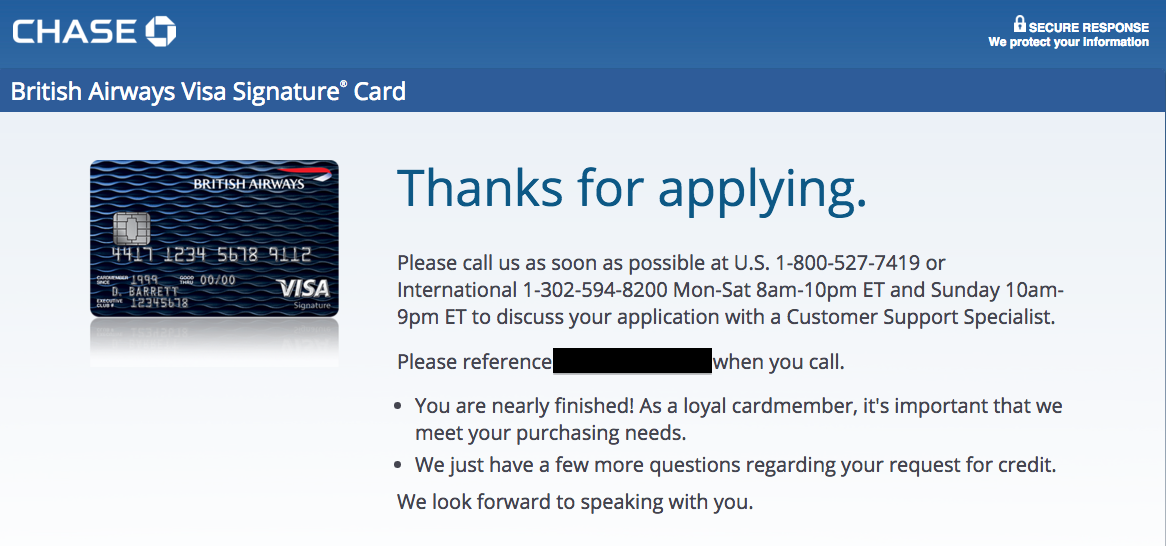

This morning, I went ahead and applied for the card and immediately received a “application pending” notification. For those that have been denied due to the “5/24” rule, they typically immediately receive a denial notification, so this definitely gave me hope.

I called Chase and gave them the reference number given on my application. I was told I have too much outstanding credit with Chase and my application can be processed if I move some credit around. They moved $10k credit from my Chase Sapphire Preferred card to my Chase British Airways card and I was instantly approved.

I called Chase and gave them the reference number given on my application. I was told I have too much outstanding credit with Chase and my application can be processed if I move some credit around. They moved $10k credit from my Chase Sapphire Preferred card to my Chase British Airways card and I was instantly approved.

This means as of today, the Chase British Airways card is still not impacted by this “5/24” rule! Of course there might be others not impacted as well, but I can only speak based on personal experience.

Comment below with your experience on being approved or denied for a Chase credit card over the past few days!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

*not yet in EFFECT

Unable to view any comments. Am I the only one who can’t see them?

you applied for a card that is supposedly not under the 5/24 rule… not a terribly helpful data point.

@billy – Not sure how that is true. It was reported a few months ago that ALL co-branded and business cards would follow the rule. I am now showing a data point that not all cards are following under this rule, i.e., the Chase British Airways credit card.

I really hate to have to be the one to do this, but, um… *effect

Don’t you guys have editors or someone to proof your articles before you publish? 🙂

Andrew G, she probably doesn’t. Perhaps you would like to volunteer.

Also, I really hate to have to be the one to do this, but, um… someone (ATLJason) already pointing out this minor and common typo. So, your post was redundant.

Don’t you guys have editors or someone to proof your posts before you publish? 🙂 🙂

@Andrew – It has been updated. I wish I had an editor, but I am a one women show.

I was denied the Chase Southwest Card on May 23 due to the 5/24 rule.

@Shaam – Thank you for sharing!

I just had all of my Transunion inquiries deleted – I am currently in dispute with Equifax and Experian – you’re all going about this the wrong way. Get the inquiries deleted then apply…I’ll keep you posted

@Tim – Interesting. Definitely keep me posted!

I too was denied SW Plus due to 5/24 rule for a application sent on 5/23/16. Specifically stated by the CSR, Due to the number of cards opened in the last 2 years and she also mentioned there is no ability for reconsideration.

@Joshua – Thank you for the data point.

How do you get inquiries deleted

Just got turned down for Chase United card due to many pulls in past two years.