If you are a loyal blog follower, you already know that I absolutely love the Southwest Companion Pass. It has allowed me to save thousands and thousands of money over the past 11+ years and is by far my favorite perk in the entire points and miles world. While there are many ways to earn the pass, one of the easiest and most common ways is by applying for one (or two!) Southwest co-branded credit card. Since the increased card offers just ended, this is a tactic many readers took to secure their pass for 2020 and 2021. (Or to even get over the hump to earn the pass for 2018 and 2019).

If you went the credit card route to earn the pass, here are some mistakes not to make to ensure your pass comes through. (Note: Southwest recently announced that starting Jan. 1, 2020 you’ll need 125,000 qualifying points to earn the pass).

1. Points reset on January 1st

All qualifying points towards the companion pass reset on January 1st. That does not mean you lose your points to redeem for a free flight, it is just that the companion pass counter resets back to zero. For example, if you have 50,000 points in your account right now and you are looking to earn another 60,000 points from a credit card offer, those remaining points must post to your account in the same calendar year.

The key is knowing when your credit card statement closes as the actual purchase date with your credit card does not matter. Let’s say your statement close date is December 15, 2019. If you meet your minimum spend on December 16, 2019, those points will not post until a few days after your January statement closes. Even though the purchases were made in 2019, since the points do not post till 2020, those 60,000 points will count towards 2020 and will not be combined with the 50,000 points earned in 2019.

2. Credit card fraud will trigger the bonus points to post

For those looking to earn the pass for 2020 and 2021 you want to make sure to not hit your minimum spend until January 1, 2020 or after. However, if your credit card number is stolen and someone the remaining amount to put you over your minimum spend threshold, the points will post to your account after that statement closes.

This means if the points post in December, that will count towards your 2019 and 2020 companion pass points and NOT your 2020 and 2021 companion pass. Even if Chase is able to square away the fraud activity and remove the charges from your account, it will still trigger the points to post, even if the deduction was made during the same billing cycle.

Unfortunately, based on reports from the past few years, Chase and Southwest will not make any accommodations to help you out. Because of this, I personally recommend not putting even a cent on your card until January 1, 2020. The more transactions you make, the higher your risk of someone stealing your credit card number.

3. Going over your minimum spend, then making returns in the same billing cycle will still trigger the bonus points to post

If you are looking to earn the pass in 2020 and 2021, make it your job to make sure you do not hit the minimum spend on your card in 2019. Once you hit the minimum spend, even if you make a return within the same billing cycle to theoretically put you under the minimum spend threshold, the points will post after the statement closes.

4. Purchases made after your December statement closes should not post until 2019, but tread with caution

Points earned from the companion pass typically post a few days after your monthly statement closes. So purchases made after your December statement closes will not post until a few days after your January statement closes. Theoretically that means if you are looking to earn the pass for 2020 and 2020, you are in the clear to make purchases after your December statement closes. While 99.99% of you will not have an issue with this, you do not want there to be an error that causes your points to post in 2019.

While I have never heard of a scenario where Chase post points right after the purchase was made, stranger things have happened and you might not want to be the one to test it out! You also want to 100% make sure you are aware of your statement close date — this is different then your statement due date!

5. Points post after your statement close date, NOT your billing due date

There are two different dates that come with each statement — your statement close date and your billing due date. Points earned will post a few days after your statement close date for all purchases made within that statement period, NOT your billing due date.

6. Points typically post a few days after your statement close date, but it could take longer.

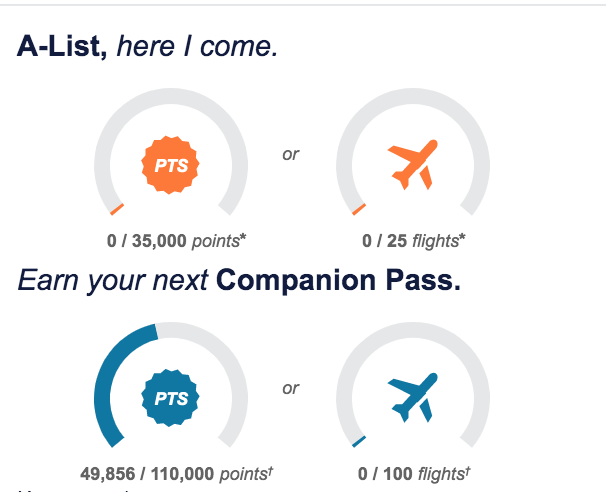

Usually, your points will post a few days after your statement close date. If the points earned from that statement put you over the 110,000 qualifying point mark, you’ll earn your Companion Pass within a day or two. Once you earn your pass, you can use it immediately. For those looking to to take a trip in late January or February, you are going to want to earn the pass as quickly as possible. But if the points do not post after the first statement cycle and instead take an extra month with the second cycle, you might not earn the pass in time for that upcoming trip. Unfortunately, I have heard of a few reports where this did happen.

Make sure to always book a fight for the passenger just in case the companion pass doesn’t come through in time. If you wait until the last minute, the price for that ticket might be astronomical. If you book ahead of time with points, you can always cancel with no fee. Also, since Southwest does not overbook their flights this also means that there should be a seat for you in case the flight is sold out when your pass eventually does come through.

7. The Annual Fee Does Not Count Towards the Minimum Spend

When you are trying to hit your minimum spend for your particular credit card offer, keep in mind that the annual fee charged to your card does NOT count towards the pass. If you just look at your total charges for the statement, your annual fee will be included, so take that charge into consideration.

Overall…

The Southwest Companion Pass is awesome and it allows a companion to fly with you an unlimited number of times during the life of the pass. The pass is valid for the remainder of the year it is earned, plus the entire following calendar year. That means if you earn the pass in December 2019, it will be valid through December 31, 2020. However, if you earn the pass in January 2020, it will be valid until December 31, 2021 — giving you almost two years of the pass! You can change your companion up to three times per year, which is great! This allows flexibility to have a friend, family member, whoever you want to fly with you throughout the year for almost free! You just pay the taxes/fees.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Ok so my Statement date is 1/1/19. I am a little nervous hitting my spend in December. Should I be ok or wait it out until January?

@Matthew – You should be okay, but I suggest waiting until December 31st. Are you able to do that? That would hit your 1/1/19 statement date and ensure you get the companion pass early in January.

If you make the final spend 12/31 /19 with a close date of 1/1/20 you most likely won’t get the award in Jan, because it will be pending a few days after the purchase in most cases.

@Dorothy – It depends on the merchant and how long they take for the transaction to post to your credit card. I have many purchases that post that day and then some purchases don’t post for a few days. For example, many online store purchases do not post until the item is shipped. I personally changed my close date to the 4th of every month to give me some lead time.

Am I able to get the bonus again on any SW card if I’ve had it before? I cancelled the cards in 2014.

Great tips, i am oh so close to getting my next companion pass. Mine actually expires, so my wife will get it this time.

A couple weeks back she got approved for the SW business card (60,000 bonus). Yesterday we were on a SW flight to Phoenix and signed up in-flight for her SW Priority card. Amazingly she was instantly approved (she was under 5/24 but we never get the instant approval). That will net us the extra 50,000 points because of the 10,000 in-flight bonus points! Only 2000 spend required. She will miss out on the 60000 offer, but we don’t need it anyway.

@Traveller Tom – Great!! Enjoy!

I got my card January 2019. My bill is due on the 21st. Next bill due October 21th 2019. I have 98,000 points now and can hit the 110,000 anytime I want. I just read that my points reset back to 0. When should I try and hit the 110,000 mark?

@Tony – ASAP. The sooner you hit the 110,000 mark, the sooner you’ll have the companion pass. Your pass will then expire Dec. 31, 2020.

If you got your business card in October and need 45k or more points via another card, when should you apply for that card and what would be the minimum spend limit?

@Jim – Are you looking to earn the pass in 2020/2021? If so, you should be able to apply for the card at any point. The minimum spend depends on the particular offer.

Applied and accepted for card #1. Card #2 will have to make up remaining miles so should I assume I go for it in January and complete min as quickly as I can and what amount would that be, $1K? Not sure

@Jim – If it is a 40k offer, typically the minimum spend is $1,000.

If going for ’20-21 companion pass is it best to set your closing date early in Month, let’s say the 1st, so all of December purchases after the 1st will get posted in 2020?

@Steven Annis – I personally think getting the closing date as early as possible is great. I did mine for the 3rd so I have Jan 1st and 2nd to help meet the minimum spend.

Will purchases made 1/1 and 1/2 make it out of “pending” before your statement posts?

Hi! I’m so confused about this and hope you can help – my due date is the 1st, but it closes on the 4th. Does all of this mean anything spent before the 4th counts toward December (2019) for points, but it wouldn’t be awarded until January 2020? And do you know how it works for Rapid Rewards shopping points too? I.e. if I purchase something on 12/31, when will the points ‘count’ for? Thank you so much for your help.

@Jayvee – All spend after your Dec. closing date will post Jan. 2020. Anything spent before Dec. 4 would post in December and could for 2019 pass. For the shopping portals, I’ve heard many different reports.

Thinking about splitting the cost of a Disney Cruise in Spring, amongst two new Southwest Business Cards for myself and two Business cards for Player 2. The paid in full date for the cruise is right after Christmas. I’ve changed the statement close dates to the 25th (of the cards we’ve been approved for so far). Going to use our end of year bonus from work to pay it all of at the end of January. Oh we’re also going to use our two new CPs to fly myself, player 2 and 2 kids to the Disney Cruise port, so we’re paying in advance with points transferred from Chase Ultimate Rewards to SW (I assume we get the points spent on the kids tickets back, once we earn the CPs in their names). Sound good?

@Points For Four – Sounds like a great plan! I am assuming your two kids will be each of your companions? If you book the kids tickets with points and cancel (to add them onto your companion), you’ll get the points back and taxes/fees will be reimbursed to the credit card paid. Enjoy!