UPATE: This post includes offers that are no longer available.

This is post #1 of a series regarding the Chase Ultimate Rewards program.

Related Posts:

- Introduction to Chase Ultimate Rewards Program

- Maximizing Chase Ultimate Rewards with Chase Freedom

- Maximizing your Chase Freedom, Chase Sapphire, Chase Ink Classic, and Chase Ink Cash Points

- Downgrading your Chase Ultimate Rewards Card to Avoid the Annual Fee

- Best Redemption for Chase Ultimate Reward Points – Hotel Stays

- Best Redemption for Chase Ultimate Reward Points – Air Travel

- Chase Sapphire Preferred vs. Chase Sapphire

- Chase Ultimate Rewards: Sapphire Preferred vs. Ink Bold

- Comparison of Four Chase Ink Ultimate Rewards Credit Cards

- Difference Between the Chase Ink Bold and Chase Ink Plus

- Top 10 Chase Ultimate Reward Questions

The Chase Ultimate Rewards program is talked about quite often, but I wonder if everyone really knows what it is. Everyone knows about American Express Membership Rewards – it’s been around for awhile now. But do you fully understand Chase Ultimate Rewards? It is just recently getting the hype and in my opinion is surpassing the Amex Membership Rewards program. While American Express has been cutting the ties with many partners, Chase is on the rise and I foresee many additional partners continuing to be added. My favorite part of the Ultimate Rewards program is the flexibility it allows. You are not pigeonholed into one hotel or airline program. You can use your points to cater towards your travel needs/wants.

1. Earning and Burning

Earning – Ultimate Reward (UR) points are earned when having the Chase Sapphire Preferred, Chase Ink Bold Business, and Chase Ink Plus credit cards. While there are a few other cards that are part of the Ultimate Rewards program, they do not include the full benefits. Those cards will be covered in future posts in this series.

Essentially Every $1 spent = 1 UR point. You will also receive bonus points with certain purchases:

- Chase Sapphire Preferred:

- 2x points on travel (or 5x points if booked through Ultimate Rewards)

- 3x points on dinning, select streaming services and select online grocery purchases

- Chase Ink Bold (not available for new applicants):Â

- 5x points on business expenses (wireless communication services, cable and satellite television and radio services, office supply stores and wholesale distributors of office supplies) up to a maximum of 200,000 bonus points (which means $50,000 of spend)

- 2x points at gas stations, hotels and motels up to a maximum of 50,000 bonus points (which again means $50,000 of spend)

- Chase Ink Plus (not available for new applicants):Â

- 5x points on business expenses (wireless communication services, cable and satellite television and radio services, office supply stores and wholesale distributors of office supplies) up to a maximum of 200,000 bonus points (which means $50,000 of spend)

- 2x points at gas stations, hotels and motels up to a maximum of 50,000 bonus points (which again means $50,000 of spend)

Redeeming – You can redeem your UR points four different ways (with transferring to a loyalty program being the best redemption value):

- Transferring to a partner loyalty program – Points can be transferred at a 1:1 ratio to:

- United

- British Airways

- Southwest Airlines

- Virgin Atlantic

- Singapore Airlines

- Hyatt

- InterContinental Hotels Group

- Marriott

- Pay for travel: You can use your points to redeem free travel with Chase’s travel booking service. This allows you to pay for anything travel related (car rental, cruises, etc.). There are no black out dates and you can earn frequent flyer points as normal. With the Chase Sapphire Preferred card, you will get a 25% bump when redeeming in this type of travel. Therefore, 1 point = 1.25 cent towards the purchase of your travel.

- Cash Back: Instead of redeeming for travel, you can use your points to receive cash back. 1 point = 1 cent cash back. Not the best redemption or recommended at all!

- Gift Cards/Entertainment: Again, not a great redemption ratio, but you can redeem your points for various gift cards or entertainment opportunities.

2. Using the Ultimate Rewards online site

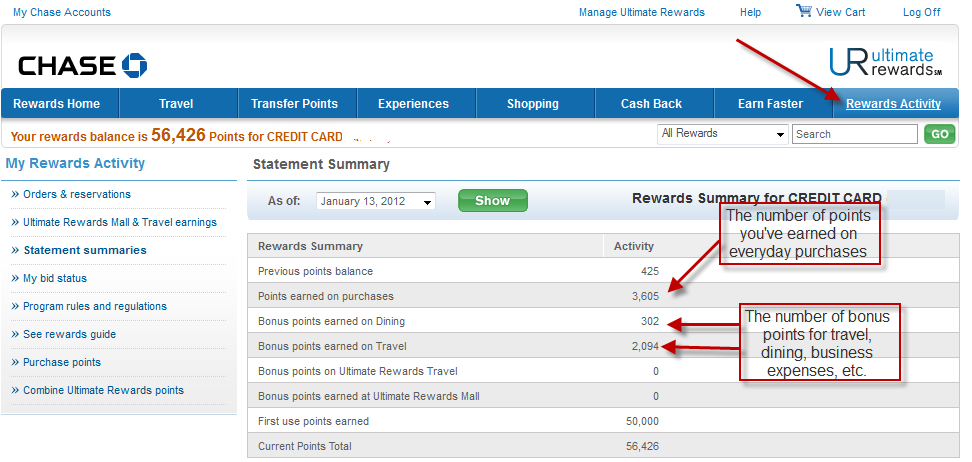

Accessing your account information – Once you log onto the Ultimate Rewards site, click the “Rewards Activity” tab. This will show you all the points you have earned (from regular spend and bonuses) during the billing cycle.

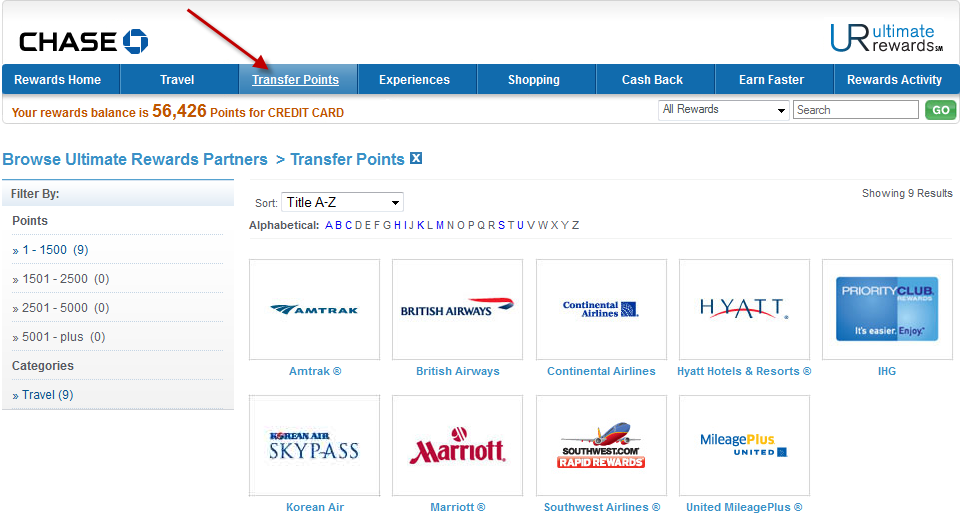

Transferring points to a loyalty rewards program – Click the “Transfer Points” tab. This will bring up all the available reward programs where you can transfer your points to. They have added a few loyalty programs recently, so I am really hoping they keep up the pace and continue to add more!

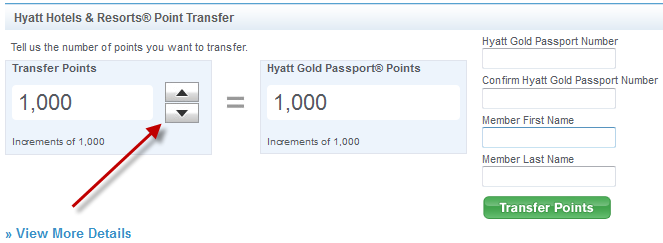

Once you select your desired program, you will need to select the number of points to transfer over along with the program information. For all programs, you must transfer in increments of 1,000 points. Also, currently they will allow you to transfer your points into anyone’s account so the names do not have to match. This is a great way to top off family accounts! Also, unlike American Express Membership Rewards there are no fees to transfer your points! Points typically transfer instantly, but remember, they cannot be reversed! It is always best to put your ticket on hold first and then transfer your points – this will ensure the award ticket you are looking to redeem is available.

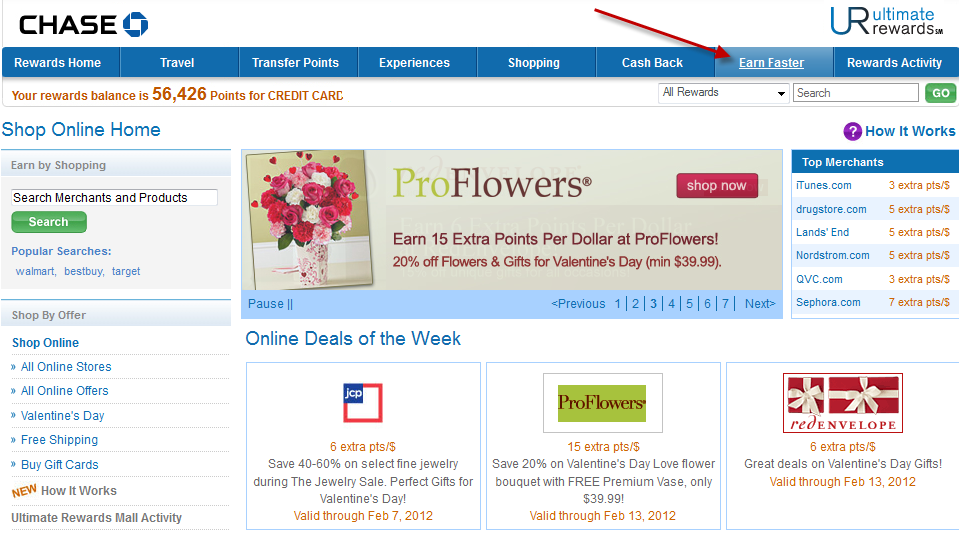

Using the Ultimate Reward shopping mall – Earn UR points on many online purchases! For everyone online purchase you make, first go to the Ultimate Rewards shopping portal. On the Ultimate Rewards site click the “Earn Faster” tab. This will bring every online merchant along with the number of points you will earn per dollar spent. Once you select the merchant it will bring up the typical online store you are used to – go shopping and earn points! Your purchase will be tracked via online cookies (if you are not a tech person, Google this). During many times throughout the year, the UR mall has some great bonuses for certain online merchants. Bonus points post pretty quickly.

3. Chase Ultimate Rewards credit card bonus

As mentioned above, the Chase Sapphire Preferred, Chase Ink Bold Business, and Chase Ink Plus credit cards are directly tied to the Ultimate Rewards program. Also, none of the cards have foreign transaction fees!

If you have any questions let me know!

Disclosure: Some links in this post are affiliate links where I get paid commission if you apply and get approved for a credit card. I will only list the best credit card offers as my goal is for you to travel for free!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Very very nice post. Only one problem I see. Your UR balance is way to low. Time for a Chase card churn for more! 😉

@DGF – I agree! If only I knew when I will apply for a mortgage!

very informative article. I recently (less than a week ago) got approved for a sapphire preferred and ink bold card. So I am hoping to get 100k (combined) UR points after I fulfill spending requirements in given time.

Since 50kUR points can be used for booking air-ticket worth $625, my Q is, Can I use 100k points to book an air ticket worth $1250??

@Shahab – All the points are essentially combined into one account and are not separated amongst the two credit cards. Enjoy that free vacation!

Great post! I have not had a chance to look it up, but may I ask how would you transfer your Freedom points to Chase Sapphire? Regarding to a mortgage, I still do not figure out how bank approves mortgage 🙁 Last year, I refinanced and got a rental in the middle of getting credit cards as well. I am in the middle of refinance again since rate drops, and just got the Chase Freedom on the same day of doing the loan app. I did/do not have problem with getting a mortgage… Thanks.

@Nguyen – Great question! That is actually in another post for within this series. Be on the look out in the next few days! Or maybe it is such an interest, that will be tomorrow’s post!

Is it possible to get a points advance like one can with Membership Rewards?

@D – I do not believe so.

Any tips for getting BOTH the Ink and Sapphire Preffered at ths same time? Is there a two browser trick?

@ORD-TGU – Essentially the two browser trick is to be able to get points for two different cards where you are limited to a one time bonus. So for the AAdvantage card, the two browser trick is great as technically you can only get the bonus points once in the time frame. However, for the Chase Ink and Sapphire you are allowed to get the 50K bonus points per new card application. However, Chase has been controlling the number of applications in a 3 month timeframe, so you will probably have to call the reconsideration line for one of them. Doesn’t matter if you do them on the same day or not (for these cards).

@ shahab: you can accumulate a total 140K UR for a RT in first class using Star Alliance Awards flight through United from N. America to SE Asia. See chart: http://www.united.com/ual/asset/United_Star_Chart_eff_after_6_15.pdf

[…] Post #1: Introduction to Chase Ultimate Rewards Program […]

If you book a hotel with UR Points, do you get your hotel program points for the cost of the stay? What about credit toward status?

@tracy – If you use your UR points as cash to book travel, you will get points and elite nights for your stay. Essentially, the hotel treats it as a paid stay.

Are transferred UR points to Southwest RR good toward the companion pass? Hmmm. Me might like.

@Mike – Unfortunately transferred points from Ultimate Rewards are not counting towards the Southwest companion pass. However, there is a roundabout way, but will lose some of the value of the points. UR points can be transferred to Hyatt and then Hyatt points can be transferred to Southwest points (which do count towards the companion pass). UR points transfer to Hyatt at a 1:1 ratio, and then you can transfer 5,000 Hyatt points to 2,400 Southwest points, so essentially losing half of the value of your points. However, if you transfer all 50,000 points from the sign up bonus to Hyatt and then transfer those 50,000 points to Southwest, you will get a 5K points. Hyatt gives you a 5k bonus when transferring 50k points or more to Southwest. These 50k UR points will ultimately get you 29,000 Southwest points.

[…] Introduction to Chase Ultimate Rewards Program […]

[…] Post #1: Introduction to Chase Ultimate Rewards Program […]

Is the transfer of points to loyalty programs instant?

You mentioned “put your ticket on hold first and then transfer your points”? How do you actually do that? Most award programs require you to use points/miles for online redemption right away.

Thanks so much! First time posting here!

@BML – many programs allow you to put your ticket on hold for at least a day or two (some even more). Which program are you looking to transfer your points to? Typically points transfer over instantly, but could potentially take up to a day. Congrats on your first comment!

I thought most airlines’ websites take miles off your account right away if you redeem online, but have not gone through the entire process, was thinking about British Airways and United. If you call them, there’d usually be extra fees. Your posts on the Chase Sapphire Preferred really makes me want to get one, along with Chase Freedom, but last time when I tried to apply Chase online, they said I had too many Chase cards (The British Airways Chase and Mileage Plus Explorer) and denied my application (even though I know I have excellent credit score). I wonder how long that period has to be before they’d approve new cards. Thanks again!

@BML – that is actually a great post topic – airline hold policies with award redemption. Thanks! I will get those two specifically for you though.

When you were denied the chase card did you call the reconsideration line? Typically people have had success, including myself, calling this department and having them shift some credit around to eventually approve you for the card.

[…] Post #1: Introduction to Chase Ultimate Rewards […]

[…] Post #1: Introduction to Chase Ultimate Rewards […]

IS it possible to transfer points from my wife’s Ultimate Rewards account to my Ultimate Rewards account? She doesn’t have the Sapphire Preferred card yet and wants me to manage all points for us both.

[…] Post #1: Introduction to Chase Ultimate Rewards Program […]

rewards2cash.com is offering 1.16 – 1.22 cents for each chase ultimate rewards so cashing out seems a great option, too.

[…] I mentioned in the Introduction post, you have many options when redeeming your points (hence, why I love the flexibility of the […]

[…] Post #1: Introduction to Chase Ultimate Rewards Program […]

[…] Post #1: Introduction to Chase Ultimate Rewards Program […]

[…] bonus points on travel purchases is just limited to airfare, unlike the Chase Sapphire Preferred card where you get 2x points on all travel (airfare, hotel, car, […]

[…] 75k points is a great offer and this is a pretty good card, although I must admit I am favoring the Ultimate Rewards program right now. The fee is waived the first year, but is then $175 which is quite high. This might be a […]

[…] points is a great offer and this is a pretty good card, although I must admit I am favoring the Ultimate Rewards program right now. The fee is waived the first year, but is then $175 which is quite high. This might be a […]

[…] Did I lose you all yet?! Hope this helps you all hit any minimum spend you need to meet and earns you extra points along the way. You can learn more about the Chase Ultimate Reward programs and the associated credit cards here. […]

[…] You can learn more about the subtle differences of these four cards in this prior blog post. You can also learn more about the Chase Ultimate Rewards program in this prior blog series. […]

[…] personally have turned to the Chase Ultimate Rewards program over the American Express Membership Rewards, but many are still extremely loyal to […]

does this still apply as I do not see transfer points on the ulitmate rewards site anymore.

thanks

@Rich – Yes it does. Which Chase card do you have?

I have the chase freedom currently, but am getting sapphire. will mine change once I have the sapphire?

@Rich – Yes, the way you can use your points is different for chase freedom card vs. chase sapphire. Once you get your sapphire card, transfer the points from your freedom account to your sapphire account to transfer to airline/hotel partner accounts.

[…] "Deals We Like" blog had a series about the Chase Ultimate Rewards Program. Might be worth bookmarking for future reference. Hope this […]

I had the same experience with the Chase cards(BA & United) on the same day (April 20). After a call to the reconsideration line, I got them both. I also applied for the CITI AMEX Personal and Visa personal on the same day (April 20)and was denied, evan after 2 calls to the recon line. I am going to wait 3 months and try again !?

[…] on the bonus offer – and assuming we see this bonus offer again. I am a bigger fan of the Chase Ultimate Rewards program, but they have never had a transfer bonus like Amex has from time to time. If you can redeem your […]

[…] Chase Ultimate Rewards Blog Series […]

[…] Sorry to say this – but it feels like you would benefit from doing some reading/research. It feels like a lot of your questions are things you should either decide based on your personal travel preferences, or very basic. For instance, here's some good information on the Ultimate Rewards program – http://dealswelike.boardingarea.com/…wards-program/ […]

[…] Chase Freedom offers 10,000 Ultimate Rewards points, which can be very valuable for free travel, and offers 5% bonus points for rotating […]

Do I need to concern for income filing if I transfer a 100K miles from UR to United? Is there certain mileage transfer which doesn’t trigger to get tax filing form?

@Lydia – You will not get a tax form for transferring miles.